Owning a Gulf-front property on 30A sounds like a dream - private beaches, stunning views, and luxury living. But the costs go far beyond the initial purchase price. From high insurance premiums to relentless maintenance, these hidden expenses can quickly add up. Here's what you need to know:

-

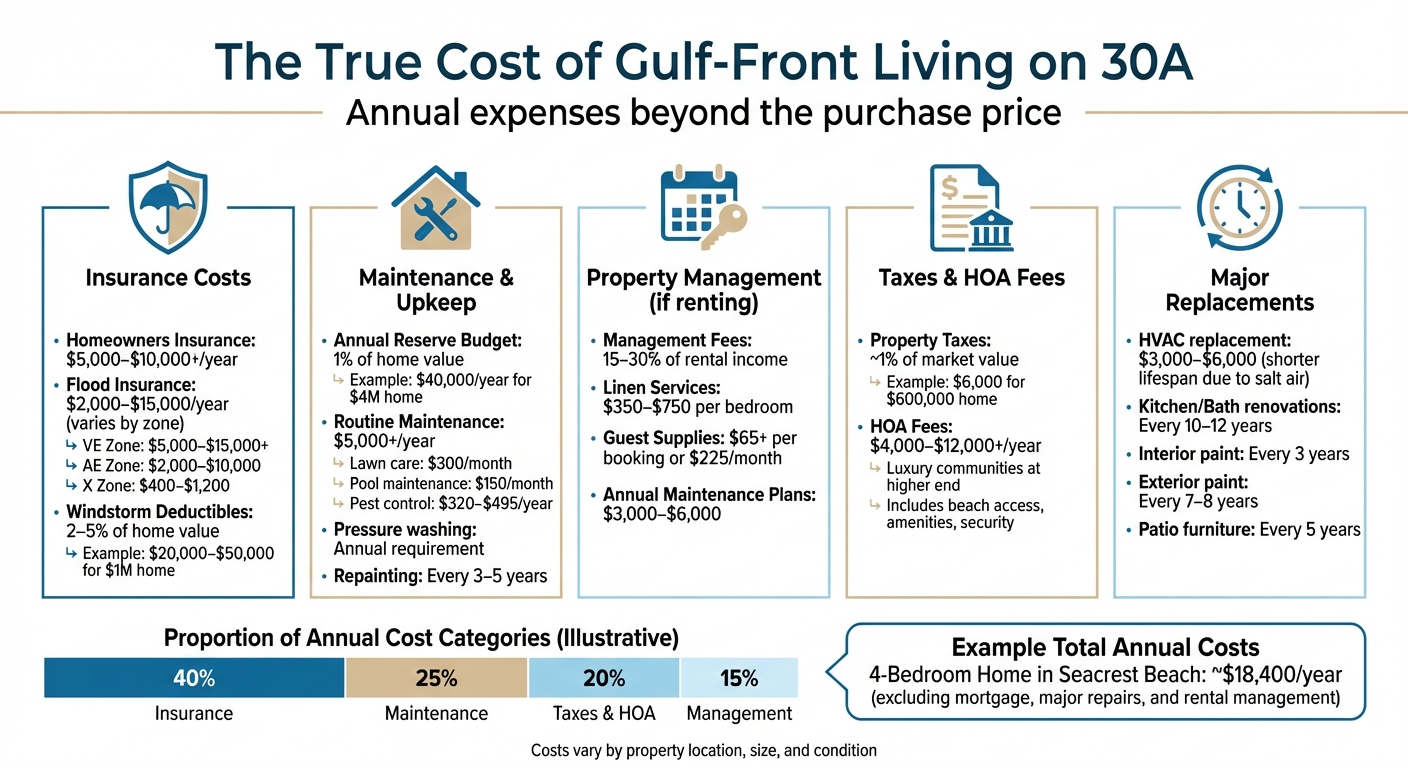

Insurance Costs

- Homeowners insurance: $5,000–$10,000+ annually.

- Flood insurance: $2,000–$15,000 per year, depending on flood zone.

- Windstorm policies: Deductibles range from 2–5% of home value.

-

Maintenance Challenges

- Salt air causes rapid corrosion of metal fixtures and damages HVAC systems.

- Coastal upkeep includes annual pressure washing, frequent repainting, and mold prevention.

- Lawn care, pool maintenance, and pest control add $5,000+ annually.

-

Rental and Management Costs

- Property management fees: 15–30% of rental income.

- Linen services, guest supplies, and cleaning add thousands yearly.

-

Taxes and HOA Fees

- Property taxes: ~1% of market value (e.g., $6,000 for a $600,000 home).

- HOA fees: $4,000–$12,000+ annually in luxury communities.

-

Long-Term Repairs

- Budget 1% of the home’s value annually for repairs (e.g., $40,000 for a $4M home).

- Frequent replacements for appliances, furniture, and exterior elements.

Key Takeaway: The true cost of owning a Gulf-front property on 30A is shaped by ongoing expenses like insurance, maintenance, and HOA fees. Planning ahead and budgeting carefully are essential to avoid surprises.

Annual Costs of Owning Gulf-Front Property on 30A Florida

The REAL Cost of Living on 30A in 2025 Explained

Insurance Costs for Coastal Properties

For those owning Gulf-front properties along 30A, the cost of insurance is often underestimated. In Florida, standard homeowners insurance usually excludes flood and wind damage, requiring separate policies or specific riders to cover these risks. With factors like hurricane exposure, proximity to the Gulf, and updated FEMA risk assessments, annual insurance expenses for beachfront homes in luxury communities such as Alys Beach or WaterColor often range between $5,000 and $10,000 or more.

Hurricane and Wind Insurance

Windstorm coverage is typically the most expensive part of a coastal insurance package, adding anywhere from $1,000 to over $5,000 annually. These policies often come with percentage-based deductibles - usually 2% to 5% of the insured home's value for named storms. For instance, a $1,000,000 home could leave the owner facing a deductible of $20,000 to $50,000 in the event of a hurricane.

Homes built after 2002 benefit from a minimum 68% discount on windstorm premiums. On top of that, features like impact-resistant windows, reinforced roofs, and hurricane shutters can secure additional savings of up to 45%, provided a licensed wind mitigation inspection confirms these upgrades.

Understanding flood insurance, discussed in the next section, is equally important for a complete picture of coastal property insurance costs.

Flood Insurance Requirements

Flood insurance is a must for properties in Special Flood Hazard Areas, and most lenders require it for Gulf-front homes. FEMA's Risk Rating 2.0 has shifted to a more property-specific approach, factoring in details like distance to water, elevation, and rebuilding costs rather than relying on general flood zone averages. This change has led to premium increases for about 77% of Florida policyholders.

Your flood zone designation significantly impacts your annual premium. For instance, homes in VE zones (areas with high-velocity wave action) can see premiums ranging from $5,000 to over $15,000 per year. Properties in AE zones typically pay between $2,000 and $10,000 annually. Even homes in lower-risk X zones, which account for 25% to 30% of all flood claims, average $400 to $1,200 per year.

The National Flood Insurance Program (NFIP) limits coverage to $250,000 for structures and $100,000 for contents. These caps often fall short of the replacement costs for luxury properties along 30A. To bridge this gap, many homeowners opt for private flood insurance, which can provide coverage limits up to $5 million, eliminate the NFIP’s 30-day waiting period, and potentially be 20% to 40% cheaper for certain risk profiles. Additionally, obtaining an Elevation Certificate to demonstrate that your home sits higher than FEMA's assumptions can reduce flood insurance rates by 20% to 50%.

Maintenance Challenges from Coastal Conditions

Owning a home near the coast isn’t just about breathtaking views and ocean breezes - it also comes with some serious upkeep challenges. Coastal exposure brings unique maintenance demands that go well beyond what inland homeowners typically face.

Take Gulf-front properties on 30A, for example. These homes endure constant exposure to salt air, high humidity, and sand, all of which speed up wear and tear. Salt-laden air is especially brutal on metal fixtures. A zinc-plated screw exposed to the sea breeze can start rusting in just 30 days and may be entirely corroded within six months. Metals like railings or even hidden components like outlet covers often need replacing every 5–6 years. These issues aren’t just cosmetic - they lead to recurring expenses, both visible and hidden.

"The continuous attack of the corrosive wind means any exposed metal that's not aluminum, stainless steel, or brass is going to rust or get pitted, and more quickly than you might think." - Gordon Daugherty

Humidity is another major player in coastal maintenance woes. Along Florida's Northwest Gulf Coast, humidity levels hover between 70–80%. This damp environment creates the perfect conditions for mold and mildew to thrive. Moisture doesn’t just settle on surfaces - it seeps into walls, damages window seals, and even causes wood to warp. After leaks or storms, materials need to dry within 24–48 hours to avoid mold growth. The combination of salt and humidity also takes a toll on appliances like HVAC systems and refrigerators, meaning they’ll likely need replacing more often than their inland counterparts.

Exterior maintenance is a constant battle. Beachfront homes require professional pressure washing at least once a year to remove salt buildup from stucco, wood, and siding. And repainting? That’s typically needed every 3 to 5 years to maintain a protective barrier against the elements. Coastal erosion adds another layer of expense, potentially costing up to $9,000 per foot for a 100-foot property.

Everyday upkeep costs also add up quickly. Lawn care averages $300 per month, pool maintenance runs about $150, and pest control ranges from $320 to $495 annually. Property inspections, recommended twice a year in the spring and fall, help catch early signs of damage like rust, peeling paint, or compromised window seals before they turn into bigger issues. All of these maintenance demands make coastal living as much about vigilance as it is about enjoying the view.

Property Management and Rental Expenses

Owning a gulf-front home on 30A often means renting it out to generate income, but it’s important to remember that rental revenue comes with its own set of expenses.

Property Management Fees

Property management companies on 30A typically charge between 15% and 30% of your gross rental revenue. While this is higher than the national average of 10–25%, it reflects the level of service that luxury coastal properties require. Some companies use a sliding scale based on total revenue, while others may advertise a lower commission rate but add guest-facing booking fees, which ultimately reduce your earnings.

For instance, an advertised 10% fee can end up costing as much as 18–22% once you factor in booking fees, credit card processing (about 4%), and other charges. Davis Bass, Owner of Live the Gulf Coast, explains:

"The right marketing strategy not only fills your calendar but also respects the unique character of your property and its setting".

The takeaway? Focus on your net income, not just the advertised commission rate.

| Company | Management Fee | Annual Maintenance | Linen Fee (per bedroom) | Marketing Fee |

|---|---|---|---|---|

| Live the Gulf Coast | 15% | $6,000 | $350 | $600 |

| 360 Blue | 20% | $3,000 | $750 | $1,000 |

| Evolve | 10% | None | $500 | $1,500 |

| Vacasa | 20–30% | None | $500 | $1,500 |

But property management fees are just one piece of the puzzle. There are other recurring costs that can significantly impact your bottom line.

Additional Rental-Related Costs

In addition to management fees, rental properties come with a host of other recurring expenses. For example, linen services for premium linens typically cost $350 to $750 per bedroom. Guest supplies - like toiletries, paper products, and coffee - may be included in your management fee, charged as a flat monthly rate of around $225, or billed per booking at $65 or more.

Many local management companies also require annual maintenance plans, which range from $3,000 to $6,000 per year. These plans cover regular inspections and preventive care, helping you avoid costly emergency repairs. Then there are startup costs: installing a smart lock can cost about $799, and an annual VRBO subscription runs around $599.

And don’t forget about cleaning fees. While guests cover cleaning costs during their stays, you’re responsible for cleaning after your own visits or when friends and family use the property. These seemingly small expenses can add up quickly, so it’s essential to account for them when calculating your net income.

sbb-itb-d06eda6

Property Taxes and HOA Fees

Owning a gulf-front property on 30A comes with more than just the initial purchase price. Two recurring costs often catch owners off guard: property taxes and HOA fees.

Property Tax Implications

Property taxes in Walton County are calculated "ad valorem", meaning they’re based on your property’s market value. Gulf-front homes, known for their premium price tags, typically incur annual taxes of roughly 1% of the property’s value. So, for a $600,000 gulf-front home, you’d be looking at around $6,000 in taxes each year.

If you’re buying as an investor or second homeowner, brace for higher costs. Florida’s Homestead Exemption and the "Save Our Homes" cap won’t apply to you. These benefits are reserved for primary residents, who can reduce their taxable value by up to $50,000 and limit annual assessment increases to 3% (or the Consumer Price Index, whichever is lower). For investment properties, there’s no such buffer - taxes are based on full market value, with only a 10% cap on annual increases. This can lead to noticeable tax hikes over time.

On the bright side, Walton County offers early payment discounts: 4% in November, 3% in December, 2% in January, and 1% in February.

But property taxes aren’t the only expense to prepare for. HOA fees are another key factor to consider.

Homeowners Association Costs

HOA fees along 30A vary widely, depending on the neighborhood and amenities offered. In simpler, non-gated communities, monthly fees might range from $50 to $400. However, condos and townhomes closer to the beach often charge between $350 and $1,500 or more per month. Upscale resort communities like Alys Beach and WaterColor sit at the higher end, with annual fees ranging from $4,000 to over $12,000.

What do these fees cover? Gulf-front associations typically maintain private beach access, dune crossovers, and resort-style amenities such as beach clubs and fitness centers. Coastal conditions - like salt, sand, and wind - also take a toll on building exteriors and metal fixtures, leading to higher maintenance needs and larger reserve funds. Additionally, many associations include master insurance, utilities, and 24/7 security in their fees.

Before committing to a purchase, ask for the association’s reserve study and recent meeting minutes. This will give you a clearer picture of potential special assessments or deferred maintenance that could result in unexpected fee increases later on.

Long-Term Repairs and Unexpected Costs

Owning a gulf-front property on 30A comes with unique financial challenges. The coastal environment, while beautiful, accelerates wear and tear on everything from structural elements to essential systems. Preparing for these demands is crucial.

Annual Reserve Budgeting

Experts suggest setting aside 1% of the property's purchase price each year for maintenance and repairs. For a $4 million gulf-front home, this translates to roughly $40,000 annually - money that should go into a dedicated reserve fund [39, 41]. Such a fund is essential for handling the inevitable costs tied to coastal living.

"The combination of salt and high humidity levels reduces the operational life of HVAC units which results in expensive maintenance expenses." – Daniel Brown, Coastal Area Guide

Certain systems, like HVAC units, are particularly vulnerable. Salt air and sand particles infiltrate these systems, leading to frequent breakdowns compared to inland homes. If an air conditioning system fails during the peak summer rental season, replacement costs can run between $3,000 and $6,000. Similarly, appliances, electronics, and plumbing systems face shorter lifespans due to constant exposure to saltwater and humidity.

Major updates follow predictable timelines. Kitchens and bathrooms typically need renovations every 10 to 12 years to maintain property value and rental appeal. Interior paint often requires refreshing every 3 years, while exterior paint may last 7 to 8 years. Even furniture wears out faster in coastal settings - patio furniture may need replacing every 5 years, mattresses every 5 to 7 years, and living room pieces every 8 to 10 years.

Having a strong reserve fund not only covers these costs but also supports ongoing preventive maintenance.

Seasonal and Preventive Maintenance

Preventive care is key to avoiding costly surprises. For example, replacing HVAC filters monthly helps combat the constant onslaught of sand and salt, while annual professional service checks can catch issues before they escalate. Roofs, windows, and doors should be inspected twice a year to spot missing shingles, leaks, or failing seals caused by high winds, salt spray, and intense sunlight [23, 3]. Damaged seals can lead to water intrusion and higher cooling costs.

"If you live near the ocean, you'll want to check on the condition of your paint and varnish at least once a year and consider repainting and revarnishing at least once every two years." – Elizabeth Boswell

Metal components face heightened risks in coastal environments. Salt-laden air accelerates corrosion on window frames, balconies, and light fixtures [3, 23]. Opting for fiberglass frames during renovations can help reduce rust issues. High humidity also fosters mold and mildew, especially on decks and in poorly ventilated spaces, making regular cleaning and monitoring essential.

Owning a coastal property requires consistent, proactive care. Skipping seasonal maintenance can lead to emergency repairs that not only disrupt your plans but also cost far more than routine upkeep.

How to Reduce Hidden Costs

Owning gulf-front property on 30A comes with its share of unavoidable expenses, but smart planning can help you cut down on those hidden costs. By shifting your approach from reactive fixes to proactive upkeep, you can save a significant amount of money over time. Here’s how you can plan maintenance and handle budgeting to keep costs in check.

Maintenance Planning

Building relationships with dependable local service providers is a game-changer, especially for remote owners. Regular property inspections and timely storm preparation can help you stay ahead of potential issues. Breaking your maintenance into seasonal tasks is another effective way to stay organized:

- Spring: Schedule HVAC servicing and remove salt buildup.

- Summer: Replace filters monthly and monitor for corrosion.

- Fall: Focus on gutter cleaning and pest control.

- Winter: Manage moisture levels and plan for major projects.

Adding smart technology to your property can also help prevent costly repairs. Automated systems for climate control and water leak detection can catch small problems before they spiral into expensive damage. Another tip? Keep a detailed log of all repairs, complete with photos and receipts. Not only will this help you track recurring issues, but it could also boost your property's resale value when the time comes.

A well-thought-out maintenance plan is one of the most effective ways to minimize unexpected costs, making it easier to stick to your budget.

Budgeting for Coastal Property Ownership

Coastal homes naturally require higher budgets due to the tougher environmental conditions. For example, a four-bedroom home in Seacrest Beach might rack up annual expenses of around $18,400. This figure typically includes utilities, pest control, property taxes, HOA fees, and insurance. Clearly, having a precise budget from the start is crucial.

To avoid surprise costs, check the financial health of any HOA by reviewing their reserve study and balance history. This step can help you steer clear of unexpected special assessments, which can be a financial burden. Another way to save? Look for properties in Zone X, which are outside the 100-year floodplain. Flood insurance premiums for these areas can be as low as $430 for primary residences or $655 for secondary homes, significantly reducing your annual expenses.

Conclusion

Owning a gulf-front property on 30A comes with more than just the initial purchase price. As Jason GaNung from Emerald Coast Realty Group explains:

"The mortgage is only half the story. On this stretch of Gulf coastline, the real monthly payment is shaped by homeowners insurance, HOA fees, and whether the home is your primary residence or a short-term rental investment".

For example, a 4-bedroom home in Seacrest Beach demonstrates the financial commitment needed, with annual carrying costs adding up even before factoring in mortgage payments.

Key expenses include insurance premiums, which can vary significantly depending on the property, flood insurance costs that hinge on zone designations, and HOA fees in upscale neighborhoods. If you're considering short-term rentals, be prepared for insurance premiums that are 30%–80% higher than those for primary residences.

To manage these costs effectively, there are steps you can take. For instance, requesting an Elevation Certificate before making an offer ensures accurate flood insurance estimates. Similarly, reviewing HOA reserve studies can help you anticipate potential special assessments. Choosing a property in Zone X or slightly farther from the Gulf can also save thousands annually on insurance while still offering the 30A lifestyle.

FAQs

What types of insurance are necessary for owning a Gulf-front property on 30A?

Owning a Gulf-front property on 30A comes with specific insurance considerations due to the coastal environment. Here are the key types of coverage you'll need to think about:

- Wind and hurricane insurance: Essential for protecting your home from storm damage caused by high winds and hurricanes.

- Flood insurance: Typically not included in standard homeowners policies, this coverage is a must for properties near the water.

- Liability coverage: Protects you in case of accidents or injuries that occur on your property.

- Dwelling coverage: Provides protection for the structure of your home against damage.

- Personal property coverage: Covers your belongings inside the home.

For coastal properties, many insurance policies include windstorm deductibles, which are calculated as a percentage of your home's insured value (e.g., 2%, 5%, or 10%). It's crucial to carefully review your policy and consult with an insurance expert to ensure you're adequately covered for any potential risks.

What maintenance challenges come with owning a Gulf-front home on 30A?

Owning a Gulf-front home on 30A offers breathtaking views and a prime location, but it also comes with its own set of challenges. The coastal environment is tough on properties, thanks to salt air, sand, high humidity, and strong winds. These factors speed up wear and tear, leading to issues like corrosion of metal fixtures, wood rot, and damage to exterior finishes.

Because of this, maintaining your home in such a setting often requires a greater investment of time and money. Tasks like applying protective coatings, replacing weathered materials, and handling structural repairs become routine necessities. Staying on top of these efforts is key to preserving your property and safeguarding your investment in this stunning yet demanding environment.

What expenses should I plan for when buying a Gulf-front property on 30A?

Owning a Gulf-front property on 30A brings some extra costs that you’ll need to consider beyond the initial purchase price. For starters, maintenance expenses tend to be higher because saltwater exposure can take a toll on your home’s exterior and systems. Then there’s insurance, which often includes hurricane and flood coverage - both of which can add up quickly. If your property is part of a community, you may also face homeowners association (HOA) fees.

Don’t forget about utility bills, which can be steeper in coastal areas, and the need for periodic repairs to protect your home from the wear and tear caused by the coastal environment. These expenses can add up, so factoring them into your budget is key to avoiding financial stress and fully enjoying life on 30A.