Living on 30A offers stunning beaches and a relaxed lifestyle, but the real costs can surprise you. Beyond home prices averaging $424,781 for single-family houses and $605,000 for condos, you'll face higher property taxes, HOA fees, layered insurance policies, and maintenance costs due to the coastal environment. Everyday expenses like utilities, dining, and transportation also run higher than average. For locals on service-industry wages, these costs can be especially challenging, while remote workers and retirees with fixed incomes may fare better.

Key Takeaways:

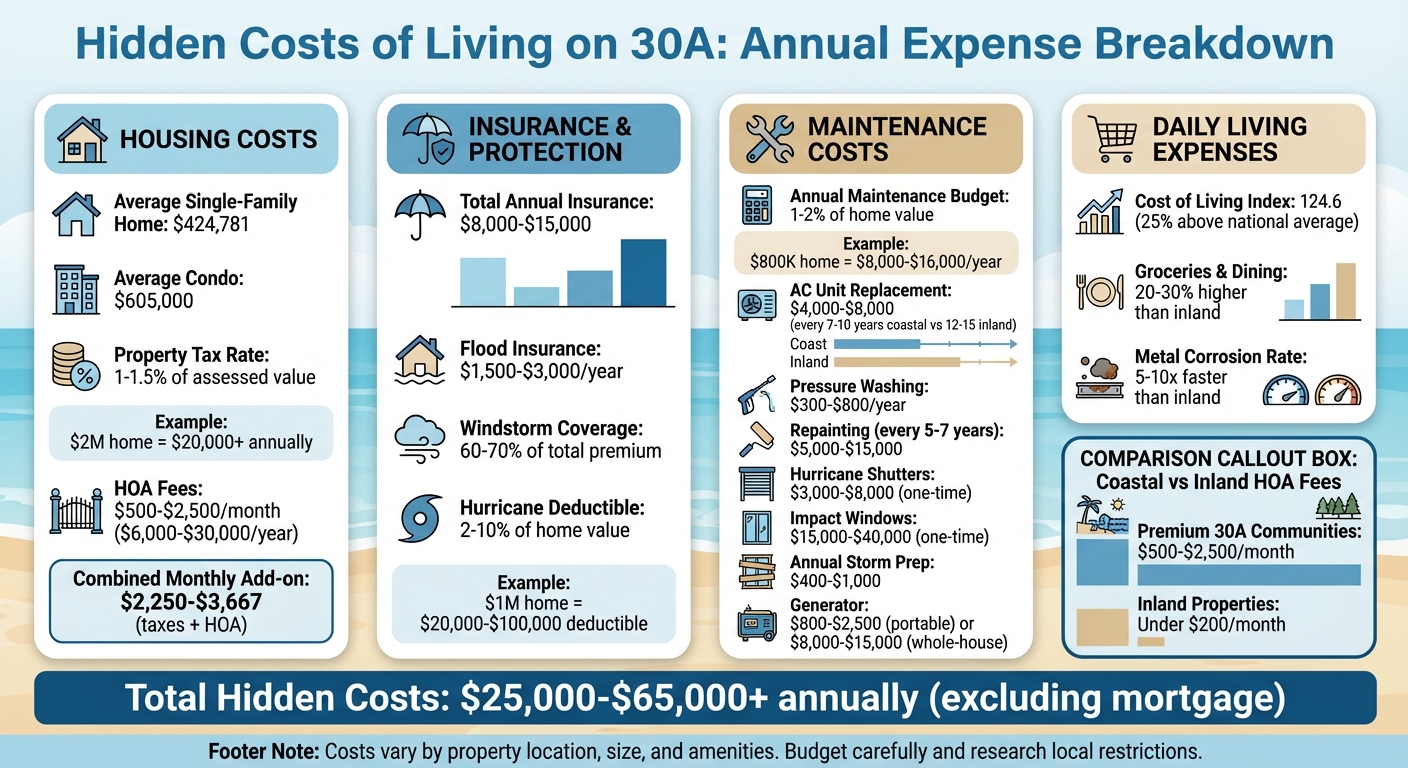

- Housing Costs: Property taxes range from 1–1.5% of assessed value, with HOA fees up to $2,500/month in premium areas.

- Insurance & Maintenance: Coastal homes require multiple insurance policies, costing $8,000–$15,000 annually, plus maintenance for salt-air damage and hurricane prep.

- Daily Living: Utilities are high due to humidity, while groceries and dining cost 20–30% more than inland areas.

- Income vs. Costs: Local wages often don’t match living expenses, but retirees and remote workers may find it easier to manage.

Budget carefully, research local restrictions (like rental laws), and use resources like sowal.co to save on daily expenses while enjoying the 30A lifestyle.

Annual Hidden Costs of Living on 30A Florida Breakdown

Housing Costs Beyond Purchase or Rent

Property Taxes and HOA Fees

Owning a property on 30A comes with more than just the purchase price. Property taxes in Walton County, especially for Gulf-front or walk-to-beach properties, can be a significant expense. While Florida’s statewide effective tax rate is typically around 0.8–1.0%, homes in South Walton often face millage rates of 10–15 mills, translating to 1–1.5% of the assessed value annually. For instance, owning a $2 million home in WaterColor could mean paying over $20,000 in property taxes every year - substantially more than a similar property located inland.

On top of that, homeowners in communities like WaterColor or Rosemary Beach face steep HOA fees, ranging from $500 to more than $2,500 per month. Annually, this adds up to between $6,000 and $30,000. When combined with property taxes of $15,000 to $20,000 for a $1.5 million coastal home, these costs can tack on an extra $2,250 to $3,667 per month - on top of your mortgage payment. These fees typically cover amenities like gated security, beach access maintenance, landscaping, pools, and community events.

The high costs are largely tied to the premium property values and the extensive services provided in these areas, such as private beach shuttles, erosion control efforts, and upscale community amenities. By contrast, HOA fees for inland properties often stay below $200 per month. If the property is your primary residence, you could benefit from a homestead exemption that reduces the assessed value by up to $50,000. Additionally, appealing your property assessment annually might provide some relief, with success rates ranging from 20–30%. These ongoing expenses play a big role in financial planning, especially when considering rental strategies.

Rental Restrictions and Lost Income

Many buyers on 30A consider short-term rentals as a way to offset the high taxes and HOA fees. However, this strategy often runs into roadblocks due to strict neighborhood covenants and zoning laws. In South Walton, some communities enforce rules that limit or outright ban short-term vacation rentals. For example, certain neighborhoods mandate a minimum 30-day lease, while others prohibit rentals entirely.

Before committing to a property, it’s critical to verify its rental eligibility. Start by reviewing county zoning records and HOA covenants to confirm whether short-term rentals are allowed. A property that can’t generate rental income could significantly alter your financial plans. To avoid surprises, plan your budget as though rental income won’t be part of the equation. Consulting local realtors who are familiar with these restrictions can help you navigate this process. For more flexibility, consider exploring eastern 30A communities, where rental rules may be less restrictive. Resources like sowal.co can also help identify budget-friendly areas with fewer limitations on rentals.

The REAL Cost of Living on 30A in 2025 Explained

Insurance and Maintenance in a Coastal Climate

Living by the coast comes with its fair share of financial hurdles, particularly when it comes to insurance and upkeep. Beyond property taxes and HOA fees, you'll need to account for the added costs of protecting and maintaining your home in a challenging environment.

Homeowners, Windstorm, and Flood Insurance

If you're eyeing property near the Gulf, be prepared to juggle multiple insurance policies. Most lenders will require a standard homeowners policy, plus separate flood insurance - often through the NFIP or a private insurer - if your property lies in or near a FEMA-designated Special Flood Hazard Area. On top of that, windstorm and hurricane coverage is typically sold separately and may come from providers like Citizens Property Insurance, Florida’s state-backed insurer of last resort.

For many South Walton homes, annual premiums can range from $8,000 to $15,000. Flood insurance alone often costs between $1,500 and $3,000 per year in high-risk areas, far exceeding the state average of $900–$1,000. Windstorm coverage can be a major chunk of your total insurance bill, often making up 60–70% of the premium. And don't overlook hurricane deductibles - these are usually percentage-based, ranging from 2–10% of your home's insured value. For example, a $1,000,000 home could carry a deductible of $20,000 to $100,000.

Before committing to a purchase, talk to insurers about hurricane deductibles and potential exclusions. Does the policy cover wind-driven rain? What about pools, docks, screen enclosures, or short-term rentals? Elevation and wind-mitigation inspections can help lower premiums, especially if upgrades like impact windows, roof straps, or secondary water barriers are installed. Local insurance agents can provide tailored advice to help you get the best coverage.

But insurance is only part of the story - coastal maintenance is a whole other beast.

Salt-Air Damage

The salty air, high humidity, and ever-present sand along the coast can wreak havoc on your property. Metal fixtures, railings, and fasteners near the ocean often show rust within just a year or two without protective coatings. Experts note that metal components in these areas can corrode 5–10 times faster than they would inland, slashing the lifespan of items like AC condensers and fasteners.

For example, outdoor AC units in coastal areas tend to last only 7–10 years, compared to 12–15 years in less salty environments. Replacing one of these units can set you back $4,000 to $8,000. Other recurring costs include annual pressure washing (around $300–$800), repainting your home every 5–7 years with marine-grade coatings ($5,000–$15,000), and treating rust on outdoor fixtures every 1–3 years.

A good rule of thumb is to budget 1–2% of your home's value each year for maintenance. On an $800,000 home, that’s $8,000–$16,000 annually, with a portion specifically allocated to combating salt-air damage, HVAC wear, and exterior upkeep. Regular roof inspections and HVAC servicing can help prevent costly repairs and might even reduce your insurance premiums.

And then, of course, there’s the ever-present threat of hurricanes.

Hurricane Preparation and Recovery

Hurricane prep isn’t a one-and-done expense - it’s something you’ll need to plan for every year. Installing hurricane shutters for a modest home typically costs $3,000 to $8,000, depending on the type and number of openings. Larger homes with impact windows and doors could see costs soar to $15,000–$40,000 or more. Roof upgrades, like wind-rated coverings and proper strapping, can add thousands to a re-roofing project, but they might earn you insurance credits that lower premiums.

Even without a hurricane making landfall, you’ll need to budget for annual preparation. Florida’s Division of Emergency Management advises setting aside $400 to $1,000 per year for hurricane supplies, shutter maintenance, and generator upkeep. Basic supplies alone can cost $400–$600, while portable generators range from $800 to $2,500. For a whole-house standby generator, expect to pay $8,000–$15,000 or more, including installation. Annual maintenance for these systems is typically a few hundred dollars but ensures they’re ready when needed - and may even qualify you for insurance discounts.

Post-storm recovery can be another financial hurdle. Deductibles, temporary lodging, and tree removal can quickly add up to thousands of dollars. If your home has a percentage-based hurricane deductible, you’ll need an emergency fund that can handle five-figure costs. Setting up automatic transfers into a dedicated “insurance and storm fund” is a smart way to prepare for these expenses without disrupting your regular budget.

For new homeowners along 30A, it’s vital to factor in these higher insurance premiums, storm prep costs, and maintenance needs when planning your budget. Resources like sowal.co offer localized tips and advice for navigating these challenges in South Walton and the surrounding coastline.

sbb-itb-d06eda6

Everyday Expenses That Surprise New Residents

Living along 30A comes with its perks - stunning beaches, a laid-back vibe, and plenty of sunshine. But the cost of daily life here can catch newcomers off guard. From utility bills to dining out, the Gulf Coast's climate and steady flow of tourists add a premium to everyday expenses.

High Utility Bills

The coastal humidity means running the air conditioner and dehumidifier almost year-round, especially during the sweltering summer months. This can send electricity bills soaring. Add in the extra water usage for rinsing off sand or using outdoor showers, and utility costs can quickly pile up. To keep things manageable, many residents invest in programmable thermostats, seal windows and doors to block salty air, and stay on top of HVAC maintenance. Timing heavy appliance use during off-peak hours is another trick locals use to save on energy costs.

But utilities aren’t the only area where 30A living stretches the budget - shopping and dining bring their own surprises.

Tourism-Driven Grocery and Dining Prices

Walton County’s cost of living index sits at 124.6, which is about 25% higher than the national average. That extra expense is easy to spot at grocery stores, where premium brands and specialty items come with higher price tags - sometimes 20–30% more than what you’d pay inland.

Dining out follows the same pattern. While casual beachfront spots can be moderately priced, upscale restaurants often charge a premium. To keep dining costs under control, locals often seek out neighborhood favorites like Black Bear Bread Co. or Chanticleer Eatery. Websites like sowal.co are also helpful for discovering hidden gems and happy-hour specials, letting residents enjoy the area’s food scene without breaking the bank.

Transportation and Parking

Transportation costs can sneak up on you, especially if you own a golf cart - a popular way to get around 30A. Street-legal carts require registration, insurance, regular maintenance, and, for electric models, battery replacements. These annual expenses can add up to a few thousand dollars. Some homeowners' associations even tack on extra fees for parking or storing these vehicles.

Parking is another challenge, particularly during peak tourist seasons. Free parking near popular beaches and town centers fills up fast, leaving residents to rely on paid lots, valet services, or parking farther away and dealing with hourly fees. To avoid these hassles, many locals plan errands during quieter times, bike to nearby spots, or scout out free parking options in advance.

Balancing these everyday costs with the joys of living on 30A requires some thoughtful planning, but it’s all part of embracing life in this unique coastal community.

Balancing Lifestyle and Income

Income vs. Local Wages

Living and working in the 30A area comes with a unique challenge: modest local wages paired with high living costs. Jobs in restaurants, retail, and beach services often pay hourly rates typical of Walton County's service industry. But these workers face the same steep rents, insurance premiums, and grocery bills as everyone else. On the other hand, remote workers earning national-level salaries and retirees who purchased homes before the recent surge in property values are better equipped to handle these expenses. For new retirees and those relying on local wages, the gap between income and living costs can feel overwhelming. This disparity makes careful planning around location and expenses an absolute must for anyone considering a move to the area.

Choosing the Right Location for Your Budget

Where you choose to live in the 30A region has a huge impact on your budget. Beachfront properties, while stunning, come with hefty price tags - often costing thousands more annually than homes just 15–30 minutes inland. Opting for these nearby communities can significantly reduce expenses without sacrificing access to the beach. To avoid surprises, gather detailed estimates for expenses like insurance, HOA fees, property taxes, and utilities from different areas. Compare costs between prime beachfront zones and more affordable inland neighborhoods. A little research upfront can save you from financial headaches later.

Using Local Resources to Save Money

Smart use of local resources can also stretch your budget. Websites like sowal.co are treasure troves of information on local events, hidden gems, and off-season deals. Take advantage of farmers markets, live music nights, and happy-hour specials at local restaurants. Public beach accesses and natural spots like Grayton Beach State Park offer free or low-cost options for hiking, swimming, and wildlife viewing. By shifting from a tourist mindset to a local one, you can enjoy the area’s perks without overspending. Make it a habit to check local guides and newsletters weekly - they’re packed with recurring free events and money-saving tips. This small adjustment can shave hundreds off your entertainment budget while keeping your social life vibrant.

Conclusion

Living on 30A comes with expenses that can catch even the most prepared off guard. From taxes and HOA fees to insurance and the upkeep required for coastal properties, these hidden costs call for thoughtful financial planning. The higher-than-average expenses in this area make careful budgeting a must.

To tackle these financial hurdles, a few practical strategies can help. Shop around for insurance by comparing quotes from different carriers and adjusting deductibles to strike the right balance between premiums and risk. Set aside a dedicated storm fund to cover hurricane-related costs and other unexpected expenses. If you're open to living slightly inland, you might find more affordable property and insurance rates while still enjoying easy access to the beach. And don’t forget - Florida’s lack of state income tax can help offset some of these higher costs.

Getting to know the area can also help you save. Local tips, like visiting farmers markets, taking advantage of happy-hour deals, and participating in community events, can make a noticeable difference in your monthly budget.

Ultimately, making 30A living work depends on aligning your income with the area’s cost of living. Remote workers with national-level salaries and retirees who purchased homes before the recent price hikes often find it easier to manage. However, those relying on local service-industry wages may face more significant challenges. Before making the move, take the time to compare your income with local wages and get a clear picture of the costs to avoid any unpleasant surprises.

With smart planning and informed decisions, you can make the most of life on 30A without letting hidden expenses derail your coastal dream.

FAQs

What unexpected expenses should you be aware of when living on 30A?

Living on 30A comes with its fair share of unexpected expenses that might surprise newcomers. For starters, property prices in this highly desirable area are well above the national average. On top of that, home insurance premiums can be hefty due to the region’s vulnerability to hurricanes and flooding. If you're eyeing a beachfront property, be prepared for maintenance costs to add up quickly - salt air and high humidity can take a toll on homes, speeding up wear and tear.

Another factor to consider is utility bills, which often climb during the sweltering summer months when air conditioning usage is at its peak. To keep these costs in check, it’s a good idea to budget carefully, opt for weather-resistant materials when maintaining or upgrading your home, and look into energy-efficient improvements that can help you save in the long run.

What are the best ways to handle high insurance and maintenance costs for a coastal home?

Managing the expenses of owning a coastal home in South Walton can feel like a balancing act, but a bit of proactive planning can make all the difference. Start by choosing durable, weather-resistant materials for construction or renovations. These materials are designed to handle the tough coastal environment, helping you cut down on long-term repair costs. Regular inspections are another must - they can help you spot and fix small issues before they turn into major (and expensive) headaches.

When it comes to insurance, take the time to shop around for policies that cover hurricanes and flooding. Comprehensive coverage is key in a coastal area. You might also save money by bundling policies, like combining home and auto insurance. On top of that, preventative maintenance can go a long way. Simple steps like sealing windows, reinforcing your roof, and addressing wear and tear early can help you avoid surprise expenses.

For tailored advice, consider reaching out to local professionals. Their expertise in South Walton’s unique climate can provide practical, budget-friendly solutions to help protect your home.

How can I manage the high cost of living on 30A using local resources?

Living along 30A might come with a hefty price tag, but there are plenty of ways to enjoy the area without overspending. For starters, farmers' markets are a fantastic place to grab fresh, affordable produce while supporting local vendors. Plus, the area is packed with community events that offer free or low-cost entertainment, perfect for enjoying the vibrant local scene.

When it comes to housing, taking the time to explore budget-friendly options can make a big difference. Local guides and relocation resources are great tools to help you uncover affordable housing solutions while still enjoying everything South Walton has to offer. With a little planning and resourcefulness, you can embrace the 30A lifestyle without stretching your wallet too thin.