Buying a home in a 30A gated community offers privacy, security, and resort-style amenities, but it requires careful planning. Here's what you need to know:

- Costs: Expect home prices from $500,000 to over $10 million, with HOA fees and other ongoing expenses like insurance, taxes, and maintenance.

- HOA Rules: Review restrictions on rentals, pets, parking, and exterior modifications. Understand what HOA fees cover and check for potential future assessments.

- Inspections: Coastal homes need specialized inspections for wind mitigation, flood risks, and structural durability.

- Financing: Loan terms vary for primary residences, second homes, and investment properties. Work with lenders familiar with Florida's coastal market.

- Amenities: Communities offer pools, private beach access, and more. Match features to your lifestyle or rental goals.

- Legal Review: Consult an attorney to navigate HOA rules, title issues, and coastal regulations.

Pro Tip: Visit communities in person to assess their vibe, traffic, and amenities. Resources like sowal.co can help you explore the area further.

This guide simplifies the process, helping you align your budget, lifestyle, and investment goals with the right 30A community.

Top 3 Communities for $1M–$2M Full-Time Living in Santa Rosa Beach | Privacy, Land & Lifestyle

Budgeting and Financial Planning

30A Gated Community Home Prices and Costs Guide

Setting Your Budget

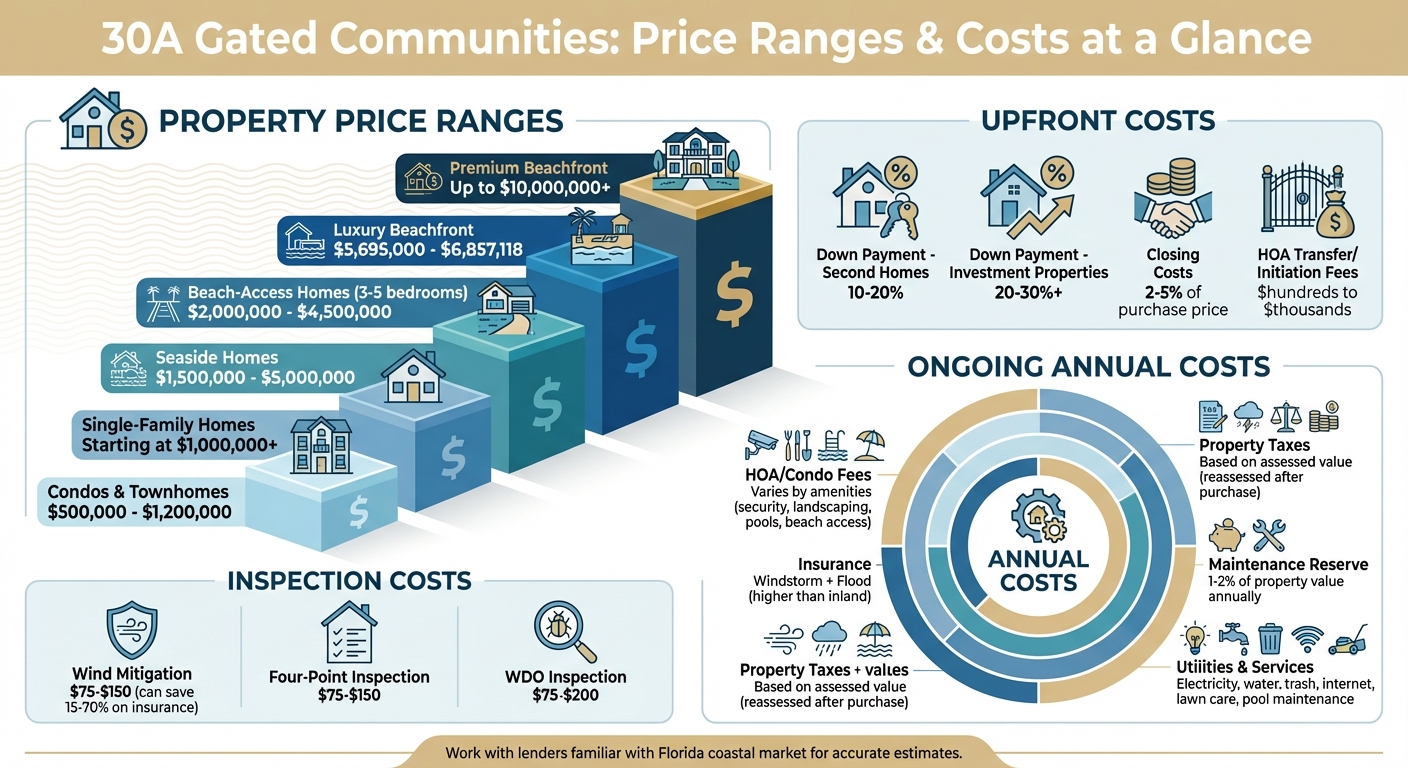

Understanding the price ranges along 30A is key to planning your purchase. In gated communities, condos and townhomes typically cost between $500,000 and $1,200,000, while single-family homes often start at $1,000,000 and rise from there. If you're eyeing beach-access neighborhoods, expect 3–5 bedroom homes to range from $2,000,000 to $4,500,000. For luxury gated beachfront properties, premium listings average between $5,695,000 and $6,857,118. For instance, homes in Seaside usually fall between $1.5 million and $5 million, though some beachfront properties can exceed $10 million. These benchmarks can help you set your budget, and securing lender pre-approval is a smart move before making offers.

Don't forget about upfront costs, which go beyond the purchase price. For second homes, you'll typically need a 10–20% down payment, while investment properties often require 20–30% or more. Closing costs in Florida coastal transactions generally range from 2–5% of the purchase price, covering lender fees, appraisals, title insurance, recording fees, and prepaid taxes and insurance. Additionally, gated communities may charge HOA transfer fees, capital contributions, or initiation fees - these can range from a few hundred to several thousand dollars and are used to fund reserves or amenities. If the property isn't turnkey, factor in extra costs for furnishings, linens, kitchenware, and smart locks. To avoid surprises, ask your agent for a seller's estimated net sheet and request a Loan Estimate from your lender early in the process.

Calculating Ongoing Costs

Owning a property in 30A comes with recurring expenses that go beyond your mortgage. HOA or condo fees can be significant, as they often cover security, landscaping, pools, private beach access, and sometimes exterior maintenance. Communities with more amenities - like guard gates, beach clubs, or multiple pools - tend to have higher dues. Be cautious of unusually low fees, as they might indicate underfunded reserves, which could lead to future special assessments. Review the HOA's budget, fee schedule, and reserve study to understand both routine dues and the community's ability to fund long-term projects like road repairs, boardwalk maintenance, or seawall upgrades.

Property taxes in Walton County depend on assessed value and exemptions. Use the current tax bill as a baseline, but remember that reassessment is likely after your purchase. Coastal Florida homes often require windstorm insurance and flood insurance (either through NFIP or private providers), which can be pricier than inland policies. Other ongoing costs include utilities (electricity, water, trash, and internet) and services like lawn care or pool maintenance if you're renting the property. Given the coastal environment, set aside a maintenance reserve - typically 1–2% of the property's value annually - for upkeep like exterior painting, roof repairs, and HVAC replacements.

Financing Your Purchase

How lenders classify your property - whether as a primary residence, second home, or investment property - will impact your down payment, interest rate, and debt-to-income calculations. Loans for second homes generally require you to occupy the property part-time and may restrict short-term rentals under the loan terms. If you're planning to rent the property regularly, it will likely be classified as an investment property, which comes with higher rates and stricter underwriting. While many 30A communities allow short-term rentals, some luxury gated neighborhoods limit or prohibit them to maintain a quieter atmosphere. Be sure to verify rental policies early, as they can affect both your cash flow assumptions and loan qualifications.

It's also crucial to work with lenders familiar with Florida coastal and condo financing, as some properties are considered "condotel" or non-warrantable, requiring specialized loan products. Your lender will evaluate HOA financials, reserves, insurance coverage, and litigation history - all of which can impact your risks and long-term costs. Keep in mind that lenders often discount projected rental income to 70–75% of gross estimates, so don't rely on rental income to fully cover your carrying costs. Instead, view it as a way to supplement your expenses and improve long-term returns, keeping in mind seasonal fluctuations and potential regulatory changes.

Once your financial plan is in place, you can start evaluating how each community's amenities and policies fit your lifestyle and investment goals.

Evaluating Communities and Lifestyle Fit

Community Amenities and Rules

Whether you're purchasing a full-time residence, a vacation retreat, or an income-generating rental property, the amenities and rules of the community can make or break your decision. For example, neighborhoods like WaterSound Beach and Alys Beach offer privacy, cohesive architecture, and resort-style perks - perfect for those seeking a more exclusive vibe. On the other hand, bustling hubs like Seaside and Gulf Place feature lively town centers that draw crowds and boost rental potential but may not suit everyone looking for peace and quiet.

Start by listing the amenities that are non-negotiable versus those that would be nice to have. If you're catering to families with young children or plan to use the property for family rentals, features like pools, splash pads, and bike paths might be at the top of your list. For properties aimed at upscale travelers, amenities such as beach clubs, concierge services, and high-quality fitness centers can set your rental apart. Also, make sure to check what HOA fees cover - things like lawn care, security, or beach shuttles - so you're not caught off guard by extra expenses. It's also wise to confirm whether amenities are exclusive to property owners or shared with resort guests and nearby communities. Overcrowded pools or limited beach access during peak seasons can hurt both your personal enjoyment and the property's rental appeal.

Take a thorough look at the HOA's covenants, conditions, and restrictions (CC&Rs). Pet policies, for example, can vary widely, with rules about the number, size, and breed of pets allowed, as well as leash requirements and restrictions for renters versus owners. Parking regulations are another key consideration, especially in denser areas of 30A. Look for rules about street parking, golf carts, RVs, boats, and guest parking to avoid fines or towing issues. Lastly, review architectural guidelines that may dictate paint colors, fencing, landscaping, and additions. These rules help maintain a cohesive look and protect property values, but they might limit your customization options.

Once you've assessed the amenities and rules, think about how the community's location fits into your daily life or rental strategy.

Location and Access

Where a property is located along the 24-mile stretch of 30A can significantly impact your convenience, lifestyle, and rental success. For example, gated communities like WaterSound Beach often offer private boardwalks to the Gulf, which can be a huge perk for both residents and renters. If walkability to restaurants, shops, and town centers is a priority, neighborhoods near Seaside, Rosemary Beach, or Gulf Place are ideal, allowing you or your guests to enjoy dining and entertainment without relying on a car.

For families, proximity to schools, grocery stores, and medical facilities is crucial. Meanwhile, investors might want to consider how close the property is to Highway 98 for easier access to popular destinations like Destin, Panama City Beach, and regional airports. It's a good idea to visit the area at different times of the day and year to get a sense of traffic patterns, beach crowding, and noise levels. For instance, areas near Seaside and Alys Beach can experience heavy foot and car traffic during the summer months, which might affect your daily commute or emergency access. On the flip side, quieter spots like Blue Mountain Beach or Inlet Beach, known for their larger lot sizes and more relaxed atmosphere, might appeal to those seeking extra space and privacy while still enjoying Gulf access.

To get a deeper feel for the vibe of each area - whether it's local events, dining options, or community activities - check out resources like sowal.co. This website offers insider tips on South Walton and the 30A coastline, giving you a well-rounded perspective to complement your property research.

Property Inspections and Condition Checks

Pre-Offer Inspection Checklist

Before making an offer on a property, it's essential to assess its condition thoroughly. Start with the roof - ask the listing agent for details about its age, material, and repair history. Look for missing shingles, rusted fasteners or flashing, sagging areas, or stains on soffits, which could indicate leaks. In 30A coastal areas, where storms are common, insurers often favor roofs that are less than 15–20 years old, as these typically qualify for better coverage and lower premiums.

Next, take a close look at windows and doors. Verify whether they are hurricane-rated and check for issues like fogging, swollen frames, or corroded locks and tracks. On the exterior, inspect stucco or siding for cracks, bubbling, or hairline fractures, especially around openings. Pay extra attention to balcony railings, outdoor showers, and metal stair components, as these are prone to rust - particularly on Gulf-facing sides exposed to salt spray.

Inside the home, watch for red flags like ceiling stains, musty smells, warped baseboards, cupped floors, discolored grout, or visible mold in areas like closets, under sinks, and around HVAC systems. Examine outdoor condensers for signs of corrosion on coils or casings, which are common in coastal environments and can reduce the lifespan of the equipment. After rainfall, check the yard for standing water, poorly drained landscaping, or erosion near driveways, as these issues can worsen during heavy coastal storms. Be sure to follow up with specialized inspections tailored to Florida's coastal risks.

Coastal Home Inspections

In addition to a standard home inspection, buyers in 30A should consider several Florida-specific evaluations that can impact insurance eligibility and costs. A wind mitigation inspection (typically $75–$150) evaluates features like roof deck attachment, roof-to-wall connections, roof shape, and the presence of impact-rated windows or shutters. Solid wind-mitigation scores can lead to substantial insurance discounts - sometimes as much as 15–70% on the wind portion of your policy, depending on the documented features.

A four-point inspection (around $75–$150) is another must, especially for older homes. This inspection focuses on the roof, electrical, plumbing, and HVAC systems. Issues like Federal Pacific electrical panels, polybutylene plumbing, or aging roofs may need to be addressed before an insurer agrees to provide coverage. Don’t overlook the WDO (wood-destroying organism) inspection, which typically costs $75–$200. Florida’s humid climate is ideal for termites, carpenter ants, and wood-boring beetles, and any findings could lead to treatment requirements or repair negotiations. For properties near water or with pools, it’s wise to evaluate seawalls, docks, and pool equipment to identify any deferred maintenance that could become costly later. These specialized inspections can help pinpoint potential issues before finalizing your purchase.

Assessing Durability and Future Upgrades

After completing initial inspections, focus on the property’s durability, especially under coastal conditions. Salt air, high humidity, intense sun, and wind can cause unique wear and tear on 30A homes. Corrosion is a common issue, particularly on exterior metal components like railings, hinges, door hardware, balcony supports, and HVAC coils. Signs of trouble include flaking rust, bubbling paint, and rust-stained stucco, which might indicate deeper damage. High humidity and wind-driven rain can also lead to moisture intrusion through small cracks in stucco, poorly sealed windows, or unprotected penetrations, resulting in mildew odors, visible mold, or soft drywall.

When considering long-term value, prioritize hurricane-resistant features. Homes with hip roofs tend to experience 30–40% fewer wind-related losses during hurricanes compared to homes with gable roofs. Additionally, a properly installed secondary water barrier can reduce storm-related roof leak damage by up to 40–50%. Evaluate the property’s drainage systems to ensure water is directed away from the house. Gutters, downspouts, and French drains should all function properly. If the home lacks impact-rated windows, reinforced garage doors, or sufficient storm shutters, plan for upgrades. Replacing all windows and doors with impact-rated versions can be a significant investment - potentially costing tens of thousands of dollars - but it often pays off through lower insurance costs, better storm protection, and improved energy efficiency. Document these findings to guide future negotiations and maintenance planning.

sbb-itb-d06eda6

HOA Rules and Legal Review

HOA Documents to Review

When purchasing a property in an HOA community, it’s crucial to review the HOA package provided by the seller or agent. Start by examining the CC&Rs (Covenants, Conditions, and Restrictions), Bylaws, and Articles of Incorporation. These documents outline the property rules, how the HOA operates, and its legal authority under Florida law.

Take a close look at the HOA's financial statements, including the annual budget, income and expense reports, and balance sheets. This will give you insight into whether the dues are sufficient and how funds are allocated - covering amenities like pools, beach access, security, or storm-related repairs. Check for a reserve study or schedule, which details savings for major future expenses. This can help you gauge the likelihood of unexpected special assessments. Additionally, request the last 12–24 months of board and membership meeting minutes, as well as disclosures about any pending litigation. These records can reveal governance issues or financial concerns that may impact your decision.

Use Restrictions and Community Rules

The CC&Rs and community rules in 30A gated communities often include specific restrictions that may influence both your lifestyle and investment plans. For example, short-term rental policies can vary significantly. Some communities permit nightly rentals, while others impose minimum stay requirements, limit the number of rental properties, or prohibit rentals altogether. If you’re considering using the property as a vacation rental, check the rules carefully to ensure they align with Walton County regulations and local ordinances.

Pet policies are another important area to review. These may include breed and size restrictions, limits on the number of pets, leash requirements, and rules about whether renters are allowed to have pets. High-end 30A communities often enforce strict architectural guidelines to maintain a uniform appearance. These guidelines may regulate everything from exterior materials and color schemes to fencing, landscaping, window styles, and roof types. Even minor renovations might require approval from the Architectural Review Board (ARB). Additionally, vehicle and parking rules may restrict RVs, boats, trailers, work trucks, and even street parking. Create a checklist of your essential needs and compare them against the recorded CC&Rs and community rules.

Once you’ve clarified the community rules, consult legal counsel to ensure compliance with regulatory requirements.

Legal and Regulatory Requirements

Navigating Florida’s coastal property regulations can be complex, so hiring a real estate attorney with experience in Florida law is key. A local attorney can review your contract, title work, and easements to confirm clear ownership and identify any restrictions, such as conservation or public access easements, that may overlap with HOA rules. They’ll also check for clauses related to buyer approval, transfer fees, rental caps, or rights of first refusal.

Florida’s coastal properties come with additional layers of regulation. For example, properties located seaward of the Coastal Construction Control Line (CCCL) require special permits for structural changes. Many 30A properties are in flood-prone zones, so it’s important to review FEMA flood maps and base flood elevations. Additionally, Florida building codes mandate hurricane-resistant features, such as impact glass, roof standards, and wind-resistant straps. Local dune-front ordinances may impose further restrictions to protect the environment.

A real estate attorney familiar with 30A properties can help you navigate how these regulations interact with HOA rules. They’ll also provide clarity on how these factors might affect renovation plans or mitigate risks tied to coastal living.

Pre-Closing Checklist

Verifying Repairs and Final Inspections

Start by creating a checklist based on your inspection report and repair addendum, making note of target completion dates for each item. For major repairs involving critical systems like the roof, HVAC, plumbing, electrical, or structural components, ensure the work is handled by licensed contractors. Request copies of paid invoices and warranties for each repair. In areas like 30A's coastal environment, where repairs can be tricky, ask for before-and-after photos, especially for hard-to-access spots like multi-story rooflines or crawl spaces.

Schedule a re-inspection to confirm that all repairs meet Florida code and manufacturer specifications. This step is especially crucial for hurricane-resistant features like wind-rated windows, impact doors, and roofing systems. Before releasing contingencies, have your agent provide written confirmation that all repairs have been completed and accepted. Keep copies of paid invoices, permits, warranties, and re-inspection reports for your closing file - they’ll be essential down the road.

During your final walk-through, ideally within 24 hours of closing, bring your inspection report and contract. Test all essential systems, including lighting, plumbing, HVAC, garage doors, and irrigation. Pay special attention to hurricane-related features like impact-rated windows and doors, storm shutters, and the roof’s condition. Also, check exterior cladding for cracks or moisture issues and ensure proper drainage around the property. Verify that all agreed-upon fixtures, furnishings, and any rental inventory for turnkey vacation homes are still present.

Once repairs are verified and the re-inspection is done, focus on securing access tools and essential documents.

Securing Access and Documents

After confirming that all repairs are complete, turn your attention to gathering access tools and legal documents. Ensure you receive all keys, gate remotes, access codes, and login details at or before closing. Many gated communities in the 30A area require new owners to visit the HOA office or fill out forms to activate gate credentials, so make sure this process is scheduled to avoid move-in day headaches.

Verify that your closing agent has received the HOA approval letter and estoppel certificate, which confirm current dues and help you avoid unexpected special assessments. It’s also critical to confirm that your homeowners, windstorm, and flood insurance policies are bound and effective as of the closing date. Keep in mind that Florida insurers may stop issuing new policies when a named storm is approaching, so handle this well in advance.

Review your Closing Disclosure at least three business days before closing. Double-check loan terms, cash-to-close amounts, prorated taxes, HOA dues, and any credits for repairs. Prepare an arrival packet with helpful information like HOA contacts, community rules, amenity hours, beach access maps, trash schedules, and gatehouse numbers. If you’re relocating or planning to spend significant time in the 30A area, resources like sowal.co (https://sowal.co) can provide valuable insights into neighborhood amenities and beach access points, helping you settle in with ease.

Conclusion and Next Steps

Living in a 30A gated community offers a mix of perks like added privacy, controlled access, resort-style amenities, and steady property value retention. However, these advantages often come with higher upfront costs, ongoing HOA fees, and rules that might restrict certain uses or renovations. It's important to weigh these factors carefully against your lifestyle needs and financial goals before making a decision.

The buying process can feel overwhelming - especially for out-of-state buyers - but breaking it into clear steps can make it more manageable. Start by defining your priorities. Think about your budget, whether the property will be a rental or your primary home, the amenities you can’t live without, pet policies, and guest access. Once you have a clear picture, focus on narrowing your options to a few communities that align with your needs. Some neighborhoods may cater to a quieter, more exclusive lifestyle, while others might be better suited for rentals or social gatherings.

From there, schedule in-person or virtual tours with a 30A-focused real estate agent. Review HOA documents and meeting minutes for your top choices to understand the community rules and recent discussions. Before making any commitments, work with a local inspector and a Florida real estate attorney to ensure you're fully informed about the property and its regulations.

For a closer look at life in 30A, visit sowal.co. This resource lets you explore different communities and compare key factors like tranquility, family-friendliness, and rental potential. Their relocation tips, local event listings, and hidden beach guides can give you a feel for the area beyond the gates. By combining the insights from sowal.co with your checklist, you can pinpoint the communities that best match your preferences for amenities, beach access, dining, and overall livability.

Finally, remember that 30A's real estate market has its own unique dynamics. Work with experienced local professionals who understand the area and its nuances. Plan a visit to experience the communities firsthand, and use this time to refine your decision based on the character and lifestyle each neighborhood offers.

FAQs

What factors should I include in my budget when buying a home in a 30A gated community?

When planning your budget for a home in a 30A gated community, make sure to factor in HOA fees, as these can differ depending on the amenities and services offered. You'll also need to include property taxes, homeowners insurance, and ongoing maintenance costs to keep your property in good shape. On top of that, be ready for possible special assessments, which might come up for large community projects or unplanned repairs. Accounting for these expenses upfront can make the home-buying process much smoother.

How do HOA rules affect property use and investment potential in 30A gated communities?

HOA rules play a big role in shaping how you can use your property and its potential as an investment. These rules might set limits on short-term rentals, dictate what kinds of renovations are allowed, or control exterior changes to the property. Such restrictions can directly affect your ability to generate rental income or make the customizations you want.

That’s why it’s so important to carefully go through the HOA guidelines before making a purchase. Make sure they align with your plans - whether you’re looking to live there year-round, use it as a vacation spot, or rent it out.

What inspections are essential when buying a coastal property in 30A?

When buying a coastal property in 30A, there are a few essential inspections you should prioritize to protect your investment. Begin with a flood risk assessment to gauge the property's susceptibility to flooding and determine if extra insurance might be necessary. A windstorm and hurricane resilience evaluation is equally important, given the severe weather conditions often faced in coastal areas. It's also wise to inspect for mold and moisture problems, which can be prevalent in humid climates. Lastly, ensure the home's structural integrity is checked to confirm it can handle the effects of salt air and the unique demands of a coastal environment.