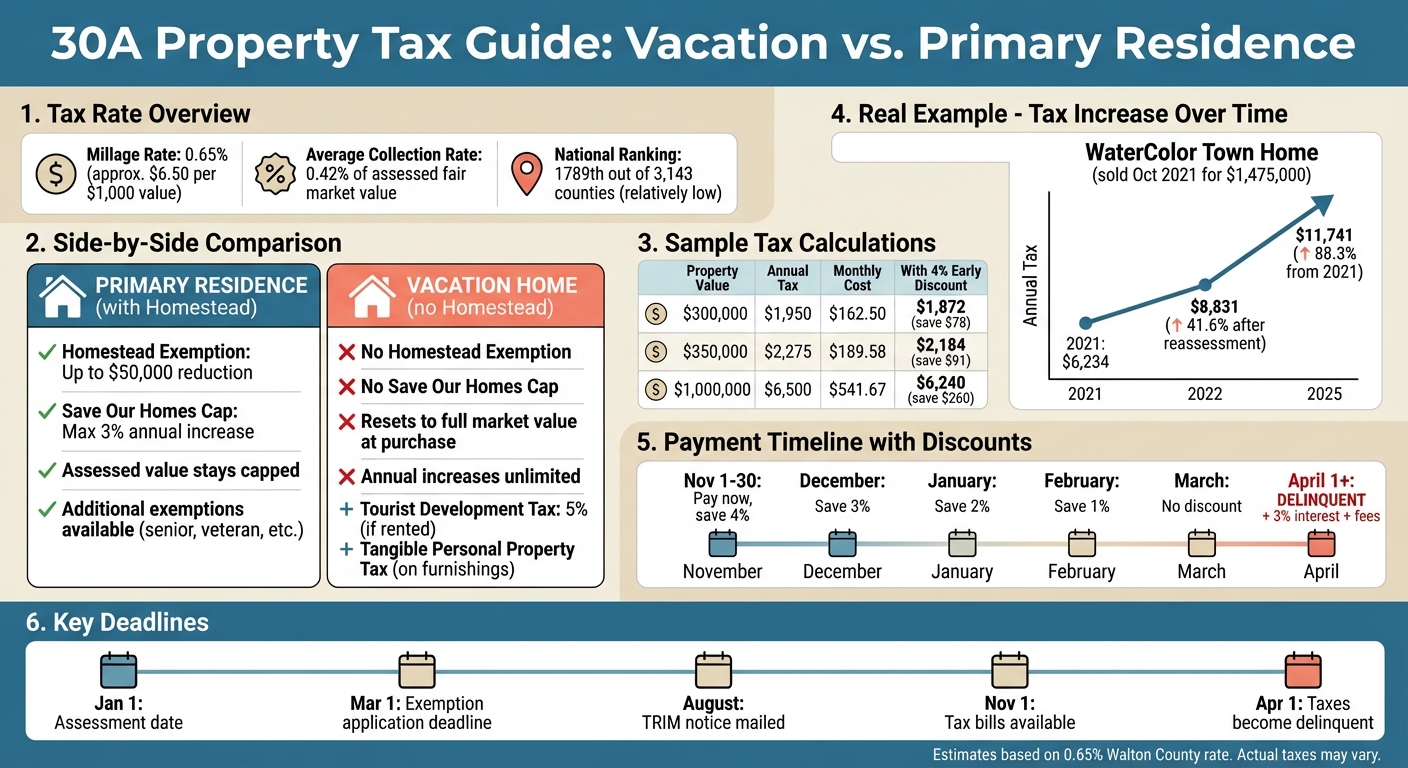

Purchasing a vacation home along 30A in Walton County, Florida, comes with unique tax considerations. Here are the key points to know:

- Higher Taxes for Vacation Homes: Unlike primary residences, vacation homes don’t qualify for Florida’s Homestead Exemption or the Save Our Homes (SOH) cap. This means taxes are based on full market value, which resets upon purchase and can increase significantly in a rising market.

- Tax Calculation: Property taxes are calculated by multiplying the assessed value by the local millage rate (about 0.65% in Walton County). For example, a $1,000,000 home would have an annual tax bill of around $6,500.

- Additional Taxes for Rentals: Short-term rentals are subject to a 5% South Walton Tourist Development Tax and Tangible Personal Property (TPP) tax on furnishings and equipment.

- Early Payment Discounts: You can save up to 4% by paying your taxes early (by November 30).

Walton County offers a relatively low tax rate compared to the national average, but vacation home buyers should plan for higher costs due to the lack of exemptions. Use online tools or consult a local CPA for accurate estimates and budgeting.

30A Property Tax Comparison: Vacation Homes vs Primary Residences

Could Florida Really End Property Taxes? | What DeSantis’s Plan Means for 30A Homeowners

How 30A Property Taxes Are Calculated

Your property tax bill is determined by multiplying your property's taxable value by the local millage rate. This taxable value is calculated through a series of steps involving various county offices. Here's a closer look at how millage rates and property values come together to shape your tax bill.

In Walton County, the process involves three key players: the Property Appraiser determines property values, taxing authorities set the millage rates, and the Tax Collector issues and collects the tax bills.

Millage Rates and Assessed Value

The millage rate represents the tax amount charged for every $1,000 of your property's taxable value. For example, one mill equals $1.00 for every $1,000 of property value. Several entities - such as the Walton County Board of County Commissioners, the School Board, and local fire districts - set their own millage rates based on their budgetary requirements.

Your property's assessed value starts with its market value, which reflects what it could sell for as of January 1. Legal assessment limits are then applied to this market value. For primary residences, the Save Our Homes cap helps limit increases in assessed value. However, vacation homes reset to full market value when sold. The taxable value is ultimately the assessed value minus any exemptions you qualify for.

It's worth noting that vacation homes don't benefit from exemptions like primary residences do, which can result in a higher taxable base. To fully understand these values, it's helpful to know how the Property Appraiser determines market value.

The Property Appraiser's Role

Gary J. Gregor, the Walton County Property Appraiser, outlines the mission of his office:

"Our primary goal in the Property Appraiser's office is to serve the people of Walton County with integrity and outstanding service while determining a fair and equitable value on properties located within the county."

The appraiser’s office calculates the "just value" (or market value) of properties as of January 1 each year. This valuation isn't arbitrary - it’s based on actual sales of similar properties. The office uses several methods, including the sales comparison, cost, and income approaches, to estimate property values.

"The property appraiser does not create the value. People establish the value by buying and selling real estate in the market place. The property appraiser has the legal responsibility to study those transactions and appraise your property accordingly."

- Walton County Property Appraiser

Florida law requires the Property Appraiser, or someone from their staff, to physically inspect each property at least once every five years, even though property values are adjusted annually based on market trends. Every August, property owners receive a TRIM (Truth in Millage) notice. This document outlines the proposed assessed value of your property and an estimate of your tax bill. If you feel the valuation is too high, this notice gives you the chance to discuss it with the appraiser’s office before the final tax bill is issued in November.

Tax Exemptions and Reductions for Property Owners

Florida provides several property tax exemptions, but most are reserved for properties that serve as the owner's permanent residence. If you're purchasing a vacation home or investment property in the 30A area, your tax relief options are more limited compared to those available to primary homeowners. Knowing which exemptions apply - and which don’t - can help you plan your annual tax expenses more effectively.

One benefit available to all property owners is the early payment discount. If you pay your property taxes early, you can save: 4% if paid by November 30, 3% in December, 2% in January, and 1% in February.

Why Vacation Homes Don’t Qualify for Homestead Exemption

Beyond early payment discounts, Florida’s exemption rules make a clear distinction between permanent residences and vacation properties.

The Florida Homestead Exemption allows for a reduction of up to $50,000 on a property’s assessed value, but this benefit is strictly for primary residences. To qualify, the property must be your permanent home as of January 1, and your Florida driver’s license and vehicle registration must reflect that address.

Vacation homes, second homes, and short-term rental properties are excluded from this exemption. As Randy Carroll of Randy Carroll Realty explains:

"If you're purchasing a vacation rental or second home in 30A, you won't qualify for the Florida homestead exemption or the SOH cap. As a result, your property will be taxed at full market value with no annual increase limits."

Without the Save Our Homes (SOH) cap, property taxes are adjusted annually to reflect full market value, which can lead to significant increases in a rising market. James V. Smith of Hughes Browne Group notes, "In just three years of an appreciating market, Megan's property taxes will be over 20% lower than Mark's" when comparing a homesteaded property to one taxed at full market value.

For those renting out their properties, there’s an additional tax to consider: the Tangible Personal Property (TPP) tax. This tax applies to rental furnishings and equipment and is separate from real estate property taxes. Owners must file a TPP return with the Property Appraiser’s office.

Other Exemptions You May Qualify For

While vacation homes don’t benefit from key exemptions, homeowners who establish 30A as their primary residence can take advantage of additional tax relief. Most of these require filing for the standard homestead exemption first.

| Exemption Type | Benefit Amount | Key Requirement |

|---|---|---|

| Standard Homestead | Up to $50,000 | Primary residence as of January 1 |

| Senior Exemption | Additional $50,000 | Age 65+; meets low-income limits |

| Disabled Veteran | $5,000 | 10%+ service-connected disability |

| Total Disability Veteran | 100% Tax Exempt | Service-connected total/permanent disability |

| Blind Person | $5,000 | Certified legal blindness |

| First Responder | 100% Tax Exempt | Total disability in line of duty (or surviving spouse) |

| Widow/Widower | $5,000 | Un-remarried Florida resident |

Veterans with a service-connected disability of 10% or more are eligible for a $5,000 exemption, while those with total and permanent disabilities may qualify for complete property tax exemption. Seniors aged 65 and older who meet specific income limits can receive an additional $50,000 exemption on top of the standard homestead benefit.

If you’re relocating from another Florida home, you may transfer up to $500,000 of your Save Our Homes benefit to your new primary residence on 30A, provided you apply within three years. Keep in mind, the deadline to apply for all property tax exemptions in Walton County is March 1 of the tax year.

However, if you claim homestead status but rent out the property for more than 30 days per calendar year for two consecutive years, you’ll lose your homestead exemption. This rule ensures that primary residence benefits are not used for properties operating as rental businesses.

Sample Property Tax Calculations for 30A Homes

Let’s look at some examples to understand how property taxes affect different home values. These calculations illustrate the tax process and its impact on 30A vacation homes, based on Walton County's 0.65% tax rate. Keep in mind, vacation homes are taxed on their full purchase price.

Tax Calculation for a $350,000 Home

For a vacation home valued at $350,000, the annual property tax comes to $2,275 - or $2,184 if you take advantage of the early payment discount. The math is simple: multiply the home's assessed value (equal to the purchase price) by the 0.65% tax rate.

Paying your taxes in November earns you a 4% discount, saving $91 and reducing your total to $2,184. That breaks down to $189.58 per month, or $182 with the discount. Keep in mind, additional non-ad valorem fees could apply. The table below provides a side-by-side comparison for various property values.

Comparing Taxes: $300,000 vs. $1,000,000 Properties

In Walton County, property taxes increase in direct proportion to a home's value. For example, a $300,000 vacation home has an annual tax bill of $1,950, while a $1,000,000 property racks up $6,500 in yearly taxes.

| Property Value | Estimated Annual Tax | Monthly Equivalent | Discount Savings |

|---|---|---|---|

| $300,000 | $1,950 | $162.50 | $78 |

| $350,000 | $2,275 | $189.58 | $91 |

| $1,000,000 | $6,500 | $541.67 | $260 |

Here’s a real-life example: A WaterColor Town Home Center unit sold for $1,475,000 in October 2021. Its property tax rose from $6,234 in 2021 to $8,831 in 2022 after the assessed value reset. By 2025, taxes increased further to $11,741. This highlights how vacation home taxes can climb significantly with market appreciation, especially without the Save Our Homes cap to limit annual growth.

sbb-itb-d06eda6

How and When to Pay Your Property Taxes

In Walton County, property tax collection kicks off on November 1 for the tax year spanning January 1 to December 31, with taxes becoming delinquent starting April 1. If you're paying real estate taxes, the full amount is due at once unless you're eligible for an installment payment plan or a homestead tax deferral. To avoid penalties, it's essential to review your tax calculations and stick to the deadlines. Keep an eye on the tax calendar to meet all deadlines and take advantage of any available discounts.

Property Tax Calendar and Deadlines

Paying your property taxes early comes with discounts, depending on when you make the payment. Here’s how the discount schedule works:

- 4% discount: Pay by November 30.

- 3% discount: Pay by December 31.

- 2% discount: Pay by January 31.

- 1% discount: Pay by February 29.

If you pay in March, there’s no discount, and taxes paid after March 31 will incur a 3% interest charge along with advertising fees. Mortgage companies managing escrow accounts are required to make payments during the November discount period. For delinquent taxes, the Tax Collector will advertise the properties within 45 days, and the advertising costs will be added to your bill.

Payment Methods and Options

Once you’ve sorted out your deadlines, you can choose from several payment options. The Walton County Tax Collector offers these convenient methods:

- Online: Payments can be made through the Tax Collector’s website using credit/debit cards (Visa, MasterCard, American Express, Discover), e-checks, Apple Pay, PayPal, or Google Pay. E-checks are free, but credit/debit card payments come with a 2.95% fee (minimum $2.95) online or 2.35% (minimum $2.00) for in-person transactions.

- By Mail: Send your check to PO Box 510, DeFuniak Springs, FL 32435. For overnight delivery, use 571 US Hwy 90E, DeFuniak Springs, FL 32433.

- Wire Transfers: Both domestic and international wire transfers are accepted, as long as you include the correct property identification numbers.

- Installment Plan: If spreading payments over the year works better for you, apply for the installment plan by April 30. This plan divides payments into four installments due in June, September, December, and March.

Recent Changes in 30A Property Taxes

Property taxes in the 30A area are influenced by shifting market conditions and local budget requirements. Keeping up with these changes ensures you're prepared for what you'll actually pay, rather than relying on outdated estimates. With 2026 on the horizon, these trends are shaping the landscape for property tax adjustments.

2026 Millage Rate Decrease

Walton County calculates property taxes using a millage system - where one mill equals $1 per $1,000 of assessed property value. On average, the county collects 0.42% of a property's assessed fair market value as property tax. For a home valued at $199,800, this translates to a median annual tax of $831. Compared to other U.S. counties, Walton County ranks 1789th out of 3,143 for median property taxes collected, highlighting its relatively low tax burden among coastal areas.

Adjustments to the millage rate are determined by local taxing authorities, including the Walton County Board of County Commissioners, the School Board, and special districts like South Walton Fire. These rates are reviewed annually, using the certified tax roll provided by the Property Appraiser each October. The balancing act between revenue needs and property value trends directly impacts the millage rate changes.

How Property Value Changes Affect Your Tax Bill

Beyond millage rates, shifts in property values play a significant role in determining your tax bill. Recent data reveals that property value growth in the 30A area has slowed. As of March 2025, the median home value in Walton County was $478,810, with an average annual tax bill of $3,340. However, these figures vary widely depending on the community. For instance, Inlet Beach reported median home values of $1,248,929, leading to annual tax bills of $8,557, while Santa Rosa Beach had median home values of $745,514, with taxes averaging $4,766.

Vacation homes face additional tax challenges compared to primary residences. Unlike primary homes, which benefit from a 3% cap on annual value increases, vacation homes reset to their full market value upon purchase. This often results in sudden and significant tax increases. While slower property appreciation may bring more stability to tax bills year-over-year, vacation homeowners remain exposed to the full market value. For prospective buyers, understanding these dynamics is crucial when planning for long-term expenses.

How to Estimate Your 30A Property Taxes

If you're planning to buy property in the 30A area, estimating your property taxes ahead of time is a smart move. It helps you plan your budget and avoid any unexpected costs. Luckily, Walton County offers online tools to simplify this process.

Using the Walton County Tax Estimator Tool

The Walton County Property Appraiser's website (waltonpa.com) is your go-to resource for calculating property taxes. You can search the tax roll using an account number, owner name, or mailing address to review both current and historical tax bills. Additionally, the Walton County Tax Collector's website provides details about current bills and payment histories. If you have the parcel ID number from your real estate agent, it can speed up your search and improve accuracy.

Keep in mind that your tax bill will likely differ from the seller's due to reassessment at the time of purchase. When ownership changes, the "Save Our Homes" cap resets, and the assessed value is adjusted to reflect the current market value. Vacation homes, for example, are taxed at their full market value.

What to Include in Your Tax Estimate

Once you’ve used the estimator to get a general idea, refine your calculations by including all applicable fees and assessments. Start with the January 1 assessed value provided by the Property Appraiser's Office. For new purchases, this value often aligns with the property’s purchase price, though it may be slightly lower. If the property will serve as your primary residence, you can apply the $50,000 Homestead Exemption. Keep in mind, however, that this exemption doesn’t apply to vacation homes.

Next, calculate the millage rate. This rate represents $1.00 in tax for every $1,000 of taxable property value. Multiple entities contribute to the millage rate for 30A properties, including the Walton County Board of County Commissioners, the School Board, and other local districts like South Walton Fire. On average, Walton County collects about 0.42% of a property's assessed fair market value as property tax.

"A millage rate is the rate of tax per thousand dollars of taxable value. The property tax due on each account is calculated by multiplying the property value less any exemptions by the millage rate."

– Walton County Tax Collector

Don’t forget to account for fixed fees tied to services like fire protection, mosquito control, or drainage. Certain neighborhoods, such as Naturewalk, Somerset, or Magnolia Creek, may have additional district-specific fees that won’t appear in the basic millage calculation. To confirm whether your property falls within these service areas, you can contact South Walton Fire at 850-267-1298 or South Walton Mosquito at 850-267-2112.

For short-term rental properties, remember to include Tangible Personal Property taxes and tourist development taxes. If your property tax situation is more complex - such as with investment properties - it’s a good idea to consult a local CPA who understands Walton County’s tax regulations. This can help you avoid expensive errors in your calculations.

Conclusion

When buying property on 30A, property taxes are an important factor to consider. Unlike primary residences, vacation homes don’t qualify for the Homestead Exemption or the Save Our Homes (SOH) cap. This means their assessed value resets to market value, potentially increasing your tax liability. It's also worth noting that you shouldn't rely on the seller's tax bill to estimate your own costs - those numbers may not reflect what you'll pay.

Walton County offers a relatively low tax rate of about 0.65%, which is significantly below the national average. For example, a property valued at $1,000,000 would generate an annual tax bill of roughly $6,500. Additionally, Florida’s lack of a state income tax helps to offset the overall tax burden.

To plan effectively, use Walton County’s online tax tools to get precise estimates. For more complex situations, like rental properties, consulting a local CPA can help you navigate additional costs, including community-specific fees, tourist development taxes for short-term rentals, and non-ad valorem assessments for services like fire protection. Paying your taxes in November can also earn you a 4% discount.

For further insights on 30A property taxes and local real estate, visit sowal.co. Staying informed and proactive can make managing your tax obligations much smoother.

FAQs

How are property taxes different for vacation homes on 30A compared to primary residences?

Vacation homes along 30A are taxed using the same base millage rate as primary residences. However, they don’t qualify for important tax perks like Florida’s homestead exemption. This exemption can lower the taxable value of a primary residence by up to $50,000 and includes the Save Our Homes cap, which restricts annual property assessment increases to 3% or the rate of inflation - whichever is lower. Unfortunately, these benefits don’t extend to second or vacation homes.

Because of this, owners of vacation homes end up paying taxes on the entire assessed market value of their property. This results in a higher effective tax rate compared to primary residences. For example, Walton County’s millage rate is roughly 0.65% of the assessed value. While primary homeowners often enjoy a reduced net tax rate thanks to the homestead exemption, vacation homes are taxed at the full rate.

Are there any additional taxes if I rent out my vacation home in 30A?

If you’re renting out your 30A vacation home as a short-term rental, you’ll need to factor in some extra taxes. Here’s what to keep in mind: Florida imposes a 6% state sales tax, Walton County adds a 1% discretionary sales tax, and there’s a Tourist Development Tax that applies locally. The Tourist Development Tax rate depends on where your property is located - 5% in South Walton and 3% in North Walton.

To stay on the right side of the law, make sure you’re collecting and remitting these taxes as required. Consulting a tax professional or a local expert can help you navigate the rules and avoid any penalties.

How do I calculate property taxes for a home on 30A?

To calculate property taxes for a home on 30A, start by checking Walton County records to determine the property's assessed value. Once you have that number, apply the current millage rate, which usually falls between 0.65% and 0.79% of the assessed value. Don’t forget to subtract any exemptions you qualify for, such as the homestead exemption of up to $50,000. If the property is a vacation home or an investment property, the exemptions might differ, so it’s essential to verify eligibility with local authorities.

Property taxes can vary based on factors like the location of the home, how the property is used, and any changes to tax rates. If you're feeling uncertain about the process, reaching out to a local expert or tax professional can help ensure everything is calculated correctly.