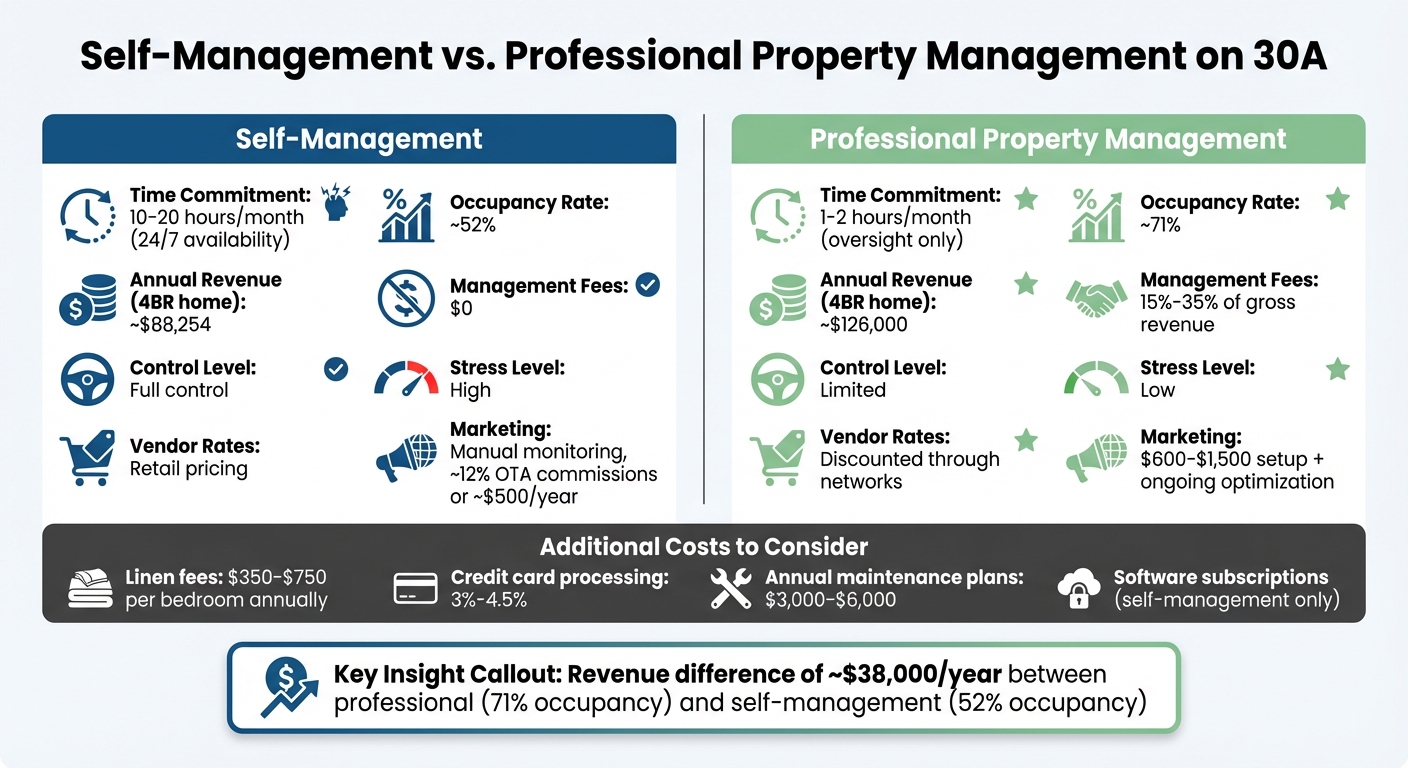

Owning a vacation rental on 30A means choosing between self-managing or hiring a property manager. Here’s the bottom line:

- Self-Management: You'll save on management fees (15%-35% of gross revenue) but take on a 24/7 job, including guest communication, maintenance, tax filings, and marketing. Expect lower occupancy rates (around 52%), which can reduce annual revenue by tens of thousands of dollars compared to professionally managed properties.

- Property Management: While expensive, professional managers handle everything - pricing, maintenance, guest services, and compliance. They often achieve higher occupancy (71%) and can boost annual revenue significantly, making the fees worthwhile for many owners.

Key Factors to Consider:

- Time: Self-management requires 10-20 hours/month; professional management frees up your time.

- Location: Living near 30A makes self-management easier; being far away favors hiring a manager.

- Experience: Hospitality and property management skills are crucial if self-managing.

- Lifestyle: Professional management reduces stress and provides a hands-off approach.

Quick Comparison:

| Feature | Self-Management | Professional Management |

|---|---|---|

| Time Commitment | High (24/7 availability) | Low (1-2 hours/month) |

| Occupancy Rates | ~52% | ~71% |

| Annual Revenue | ~$88,254 (4BR home) | ~$126,000 (4BR home) |

| Management Fees | None | 15%-35% of gross revenue |

| Control | Full | Limited |

| Stress Level | High | Low |

Your choice depends on your goals, proximity to 30A, and how much time and effort you're willing to invest.

Self-Management vs Professional Property Management on 30A: Cost and Revenue Comparison

Managing Your 30A Rental Property Yourself

Main Tasks and Responsibilities

Taking charge of your 30A rental property means wearing multiple hats. You'll handle everything from guest screening and bookings to cleaning, inspections, and maintenance. This includes managing communication with guests throughout their stay, scheduling cleaning crews after each turnover, and conducting detailed inspections to catch any issues before they grow into costly problems.

On the financial and legal side, you'll need to collect rent and ensure lodging taxes are submitted to Walton County and the State of Florida - usually on a monthly basis. Staying informed about local HOA regulations, particularly in neighborhoods like Rosemary Beach and Seaside, is also critical. Plus, you’ll need to resolve lease disputes and ensure compliance with local rules. Emergencies? They’re on your plate too, whether it’s a broken A/C unit or a plumbing issue in the middle of the night.

Marketing and maximizing revenue add another layer of responsibility. You’ll need to list your property on various platforms and build a network of trusted local vendors for housekeeping, maintenance, and pool care. Without an in-house team, you'll rely on these relationships to keep things running smoothly. Tools like dynamic pricing vs. fixed rates software can help you adjust rates as market trends fluctuate. It’s worth noting that 60% of 30A renters are families with school-age children, which can guide your pricing and marketing strategies.

With so many moving parts, managing your time effectively and using the right tools is crucial.

Time Requirements and Necessary Tools

Self-managing a rental property on 30A isn’t your typical nine-to-five job - it’s a round-the-clock commitment. Quick responses to guest inquiries are critical since bookings are 50% more likely to happen when inquiries are answered within an hour.

To stay on top of everything, you’ll need reliable tools and systems. Yield management software can help you adjust pricing based on market conditions, while subscriptions to booking platforms and credit card processing services (usually charging 3% to 4.5% per transaction) streamline operations. On the marketing side, professional photography, interactive floor plans, and polished materials can make your listing stand out. These services typically cost between $600 and $1,500 upfront but can significantly boost your property's appeal. And don’t forget a dependable local contact who can handle emergencies promptly.

Costs and Potential Savings

One of the main perks of self-management is cutting out the 15% to 30% commission that professional property managers charge on gross revenue. For a property generating $126,000 annually, this translates to savings of $18,900 to $37,800 a year. You’ll also avoid secondary fees for services like marketing, linen programs (which typically cost $350 to $750 per bedroom), and monthly guest supply fees (around $225).

However, self-management isn’t without its hidden expenses. You may pay higher retail rates for emergency repairs and routine maintenance since you won’t have the negotiating power or resources that professional managers enjoy. Additionally, costs for software subscriptions, platform fees, and credit card processing can add up quickly. The biggest potential hit to your bottom line? Lower occupancy rates. While professionally managed properties often achieve around 71% occupancy, self-managed rentals average closer to 52%. This difference can mean losing tens of thousands of dollars in annual revenue.

Best Candidates for Self-Management

Managing a 30A rental property yourself works best for owners who can handle the challenges of being on-site when needed. Living within driving distance of the property is a major advantage, as is having the ability to respond quickly to guest issues. Strong organizational skills, a knack for technology, and a calm demeanor under pressure are essential. If you enjoy hospitality and value having direct control over your property, you might find self-management rewarding.

It’s also a good fit for those with flexible schedules who can dedicate time to marketing, pricing strategies, and coordinating with vendors. Experience in real estate, hospitality, or property maintenance can make the job more manageable. As Live the Gulf Coast puts it:

The challenges here come from the seasonal tourism and the high expectations of a premium market.

On the flip side, if you’re frequently away, have a demanding full-time job, or simply don’t want property management to feel like a second career, hiring a professional manager might be a better choice.

sbb-itb-d06eda6

Working with a 30A Property Management Company

What Property Managers Do

30A property managers take care of everything related to rental operations, making life easier for property owners. They handle listing properties on major booking platforms, use professional photography and search engine-optimized marketing campaigns, and coordinate cleaning, inspections, and maintenance. They also provide 24/7 guest support and manage administrative tasks like lodging tax payments and ensuring compliance with local regulations. Their services often include concierge-level perks, such as arranging beach setups, grocery deliveries, and local transportation. On top of that, they offer damage protection plans and prepare properties for hurricane season.

One of their key strengths is optimizing rental rates. They use real-time market data to adjust pricing based on seasonal demand, local events, and competition. Some firms even maintain in-house visitor databases to create targeted marketing campaigns. As 30A Escapes explains:

"Being the top boutique management firm on 30A isn't about bedrooms and bathrooms. We sell the 'Luxury 30A Vacation Experience'".

Many companies also include programs for damage protection (often covering up to $1,500) and conduct regular "house watch" inspections during the off-season to ensure properties remain in excellent condition.

Next, let’s break down the fees and contracts so you can better understand the financial side of working with a property manager.

Fees and Contract Terms

On 30A, property management fees typically range from 15% to 35% of gross rental income. This reflects the high level of service expected in this luxury market. However, advertised rates can sometimes be misleading. For instance, a company promoting a 10% management fee might also add 12% to 15% in guest-facing booking fees, bringing the total cost closer to 18% to 22% or more.

In addition to the base commission, there are often extra fees to consider:

- Linen fees: $350 to $750 per bedroom annually

- Marketing or onboarding fees: $600 to $1,500

- Credit card processing fees: 3% to 4.5%

- Annual maintenance plans: $3,000 to $6,000

Here’s a quick comparison of costs between local boutique firms and national brands:

| Fee Type | Local Boutique (e.g., Live the Gulf Coast) | National Brands (e.g., Evolve, Vacasa) |

|---|---|---|

| Base Commission | 15% – 20% | 10% – 30% |

| Booking Fees | ~4% (Credit Card) | 12% – 25%+ (Guest-facing) |

| Maintenance Plans | $3,000 – $6,000/year | Typically reactive only |

| Linen Fees | $350 – $750 per bedroom | ~$500 per bedroom |

| Marketing Fees | $600 – $1,000 | ~$1,500 |

When reviewing contracts, look for a 30-day termination clause for flexibility. Also, check policies regarding owner use of the property. Some firms require owners to reserve about eight weeks during peak summer months (June through August), while others allow unlimited owner use. Lastly, confirm that the manager is registered to remit lodging taxes to the state and Walton County, as you remain legally responsible if they fail to pay.

Now, let’s explore how professional management can enhance your revenue and improve guest satisfaction.

Increasing Revenue and Improving Guest Satisfaction

Professional property managers can significantly increase your rental income by leveraging strategic pricing and reaching a broader market. While self-managed properties on 30A typically achieve around 52% occupancy, professionally managed homes often reach 71% occupancy. That difference can add up to tens of thousands of dollars in extra revenue each year.

Quick response times also play a role in boosting bookings. Properties are 50% more likely to secure a booking when inquiries are answered within an hour. As 30A Escapes notes:

"Lightning fast response times to rental inquiries is one of the major differences between us and our competition".

Guest satisfaction benefits from professional cleaning, proactive maintenance, and managers’ deep local knowledge. For example, managers understand family travel patterns, such as school schedules, that can influence bookings during off-peak times. Davis Bass, owner of Live the Gulf Coast, highlights this approach:

"The right marketing strategy not only fills your calendar but also respects the unique character of your property and its setting".

Positive guest experiences lead to better reviews, which in turn drive more bookings and support higher rental rates.

Best Candidates for Hiring a Property Manager

Hiring a professional property manager is ideal for owners who can’t handle on-site issues themselves. If you live far from 30A or can’t respond quickly to guest needs and emergencies, a local expert can take care of everything, from routine maintenance to hurricane preparation. For out-of-state owners, this can be a game-changer.

It’s also a great option if you want to earn passive income without the hassle of day-to-day management. For busy professionals or those with limited availability, the 15% to 35% fee is often worth the peace of mind. As Matt J, a forum contributor, puts it:

"At 25% you are paying the management company... about $71.43 per day to be responsible for your home... would $71.43 be worth your time to not deal with a drunken tenant at 2AM July 4th weekend who doesn't have air conditioning?"

Professional management also makes sense if you lack experience in hospitality, real estate, or property maintenance. The learning curve for managing a rental can be steep, and mistakes can be costly. If you’re not comfortable with technology, pricing strategies, or marketing across multiple platforms, a professional manager’s expertise can help you maximize revenue while avoiding headaches.

Lastly, if your goal is to achieve higher occupancy rates and premium pricing, professional managers bring the tools, local insights, and established booking channels to deliver results that are hard to match on your own.

Self-Management vs. Hiring Property Managers: Side-by-Side Comparison

Day-to-Day Operations

The daily responsibilities of managing a rental property vary greatly depending on whether you handle everything yourself or hire a professional. Self-management means being available around the clock for guest inquiries, check-ins, and emergencies - like dealing with a broken air conditioner at 2:00 AM. It also involves navigating monthly tax remittances for Walton County and the State of Florida.

Professional property managers take these burdens off your plate. They provide on-site staff to handle guest services, conduct monthly inspections, and perform preventive maintenance tasks like A/C tune-ups and drain cleaning. Administrative duties, including tax remittance and ensuring regulatory compliance, are also covered. However, this convenience comes with a trade-off: you’ll have less control over pricing and guest selection, whereas self-management allows you to make all decisions yourself.

| Responsibility | Self-Management | Professional Management |

|---|---|---|

| Time Commitment | 10–20 hours/month; "like a full-time job" | 1–2 hours/month for oversight |

| Guest Communication | 24/7 availability required | Dedicated service teams handle it |

| Maintenance | Build your own vendor network; reactive repairs | Established vendors; proactive inspections |

| Tax Compliance | Owner-led tax remittance | Managed by the company |

| Control Level | Full control over all decisions | Limited; daily decisions made by managers |

These differences in daily operations directly influence costs and potential revenue.

Costs and Revenue Impact

Self-management eliminates the need to pay a management fee, which typically ranges between 15% and 35% of gross revenue. However, other costs remain. You'll pay retail prices for emergency repairs, while professional managers often secure discounted vendor rates. Additionally, self-managers need to budget for software subscriptions (for bookkeeping and tenant screening) and platform fees, which can reach 12% in commissions or cost around $500 annually.

Revenue potential also varies. Professionally managed 4-bedroom homes average 71% occupancy, generating approximately $126,000 annually. In contrast, self-managed properties average 52% occupancy, bringing in around $88,254 - a difference of about $38,000 per year. Professional managers use advanced tools like yield management software and real-time market data to maximize ROI. Self-managers, on the other hand, typically rely on manual monitoring of platforms like Airbnb or Vrbo.

| Cost Factor | Self-Management | Professional Management |

|---|---|---|

| Management Fee | $0 | 15%–35% of gross revenue |

| Vendor Rates | Full retail pricing | Discounted through vendor networks |

| Software/Tools | Screening and bookkeeping subscriptions | Included in management fee |

| Marketing | OTA commissions (~12%) or ~$500/year | $600–$1,500 setup plus ongoing optimization |

| Typical Occupancy | 52% | 71% |

| Revenue (4BR Home) | ~$88,254/year | ~$126,000/year |

Risk Management and Lifestyle Impact

When you self-manage, you take on all the operational risks. This includes staying up-to-date with short-term rental rules in Walton County and Fair Housing regulations. Mistakes, such as missed tax payments or eviction errors, can lead to severe legal and financial consequences. Emergencies, like hurricane preparations or plumbing leaks during peak season, require immediate attention - a significant challenge if you’re managing from afar.

The lifestyle impact is also worth considering. Smiling Joe, a SoWal expert, puts it bluntly:

"Being a landlord is tough enough, but being a long-distant landlord is an entirely different thing. You need to consider all of the potential headache calls."

About 88% of landlords report stress from managing properties, and those juggling multiple properties or a full-time job often face burnout.

Professional management minimizes these risks and stressors. Managers handle compliance, provide 24/7 emergency coverage, and implement proactive maintenance plans to prevent small problems from escalating. This approach allows you to focus on growing your portfolio or enjoying life without constant interruptions. Of course, this convenience comes at the cost of a management fee and reduced control over daily decisions.

Deciding between these options requires a careful evaluation of the risks and lifestyle implications.

How to Decide Which Option Is Right for You

When choosing between self-management and hiring a property manager, consider these factors:

- Location: If you live far from 30A, responding to emergencies in person can be nearly impossible.

- Time Commitment: At $50/hour, spending 15 hours a month on property management equates to $750 in opportunity cost - often more than a professional manager's fee.

- Hospitality Skills: Managing rentals demands expertise in marketing, dynamic pricing, guest communication, and vendor coordination. The learning curve can be steep, and mistakes can be costly.

- Portfolio Size: Managing one property might be manageable, but overseeing multiple units can quickly become overwhelming.

-

Income vs. Control: Decide what matters more. As Matt J, another SoWal expert, advises:

"If the commission is considered too much to afford the rental, it's probably a bad idea."

If maximizing revenue and occupancy is your goal, professional management often delivers better results through superior marketing and pricing strategies. However, if you value having full control and have the time and skills to manage daily operations, self-management could be the better fit.

How to Price Your Airbnb in Destin, 30A, or Panama City Beach to Maximize Revenue Year Round (10/10)

Conclusion

Deciding between self-management and hiring a property manager on 30A ultimately comes down to your personal goals, lifestyle, and the specific needs of your property. Self-management gives you complete control and eliminates hefty management fees. However, it requires a significant time commitment and knowledge of local operations, like handling emergencies, staying compliant with taxes, and managing vendor relationships. On the other hand, professional management offers a more hands-off approach, leveraging established networks and tools to maximize revenue, though it comes with higher fees and less day-to-day control.

If you're an out-of-state owner or prioritize your time over squeezing out every last dollar of profit, professional management might be the way to go. But if you're local, enjoy the hospitality aspect, and want to increase your net income, self-management could be a better match.

Ultimately, there’s no one-size-fits-all answer. Think about your proximity to 30A, how much time you can dedicate, your technical know-how, and whether you prefer a passive investment or being more hands-on. Some owners even opt for a hybrid approach - managing bookings themselves while outsourcing maintenance and cleaning tasks.

For more detailed local advice and practical tips, check out the resources available at sowal.co to help guide your 30A investment decision.

FAQs

What does it take to self-manage a vacation rental property on 30A?

Managing a vacation rental on 30A means taking responsibility for every detail of the property’s operations. This includes promoting the home and setting competitive rental rates, which often requires adjusting prices to match seasonal demand. You'll also handle all guest communications - from responding to inquiries and confirming reservations to sharing check-in instructions and addressing any concerns during their stay.

On top of guest-related tasks, you'll need to coordinate cleaning, maintenance, and emergency repairs to keep the property in top shape. Financial responsibilities like collecting payments, tracking expenses, and ensuring compliance with local regulations, taxes, and insurance policies will also fall on your plate. If you’re new to managing rentals in South Walton, resources such as sowal.co can provide helpful advice on pricing strategies and connecting with reliable local service providers.

How do property management fees affect rental income on 30A?

Property management fees in the 30A area generally fall between 8% and 10% of your monthly rental income. While this does take a slice out of your gross revenue, a skilled management company can often make up for it by improving occupancy rates, fine-tuning pricing strategies, and ensuring guests have a smooth, enjoyable experience.

Handing over the reins to a management company can save you significant time and reduce the stress of day-to-day operations. However, it’s crucial to evaluate whether the cost of these services aligns with your financial goals and the potential boost in net income they might deliver.

What should I think about when choosing between managing my 30A rental property myself or hiring a property manager?

Deciding whether to manage your 30A rental property on your own or hire a property manager boils down to a few key considerations. One of the biggest factors is cost versus convenience. Property managers typically take a 10–15% cut of your rental income. While this reduces your profits, it also takes the burden of daily responsibilities - like guest communication, maintenance, and bookkeeping - off your shoulders. If you have the time and skills to handle these tasks, self-management could help you save money and improve your cash flow.

Time and proximity are also crucial. Managing a property yourself means being available for everything from marketing and tenant screening to handling emergency calls and coordinating cleanings. This can be tough if you live far from the property or have a packed schedule. A local property manager can step in to handle these tasks efficiently, offering quicker response times and access to reliable vendors, which is especially helpful for remote owners.

Lastly, think about expertise and risk management. Professional managers bring knowledge of local regulations, insurance requirements, and pricing strategies, which can help reduce legal risks and optimize your revenue. They also ensure your property stays in good condition and often secure better service rates, protecting its value over time. That said, self-management gives you full control over every decision, from setting rental prices to choosing tenants - a perk for those who prefer a hands-on approach.

For more tips and insights on managing your 30A property, visit sowal.co, a resource dedicated to South Walton and the 30A area.