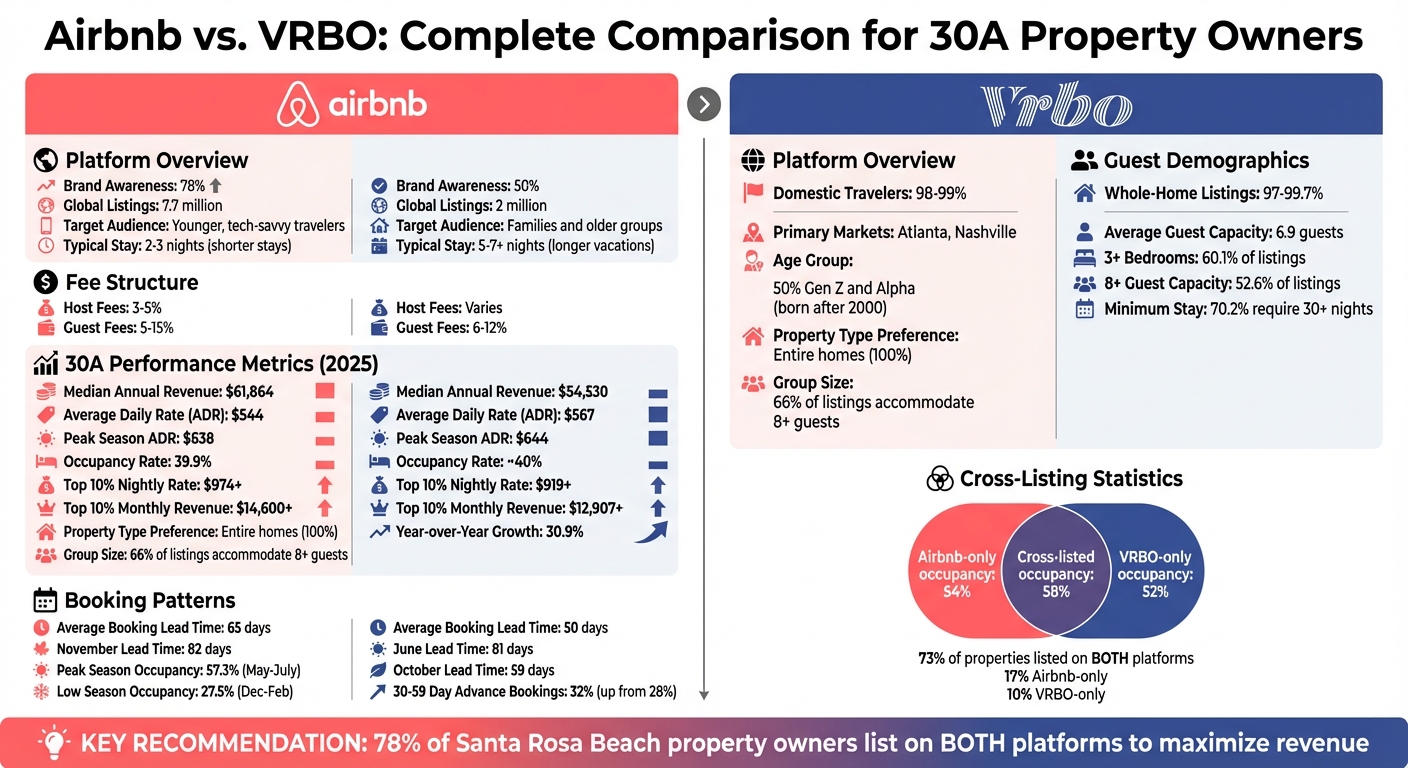

If you're renting out a vacation property in 30A, Florida, you're likely evaluating Airbnb and VRBO to maximize your revenue. Here's the bottom line:

- Airbnb attracts younger, tech-savvy guests, often booking shorter stays. It offers higher visibility but charges higher guest fees (5%-15%).

- VRBO caters to families and groups planning longer vacations. It focuses on whole-home rentals with slightly lower guest fees (6%-12%).

Both platforms show strong seasonal trends, with peak revenues in summer and lower earnings in winter. For example, in 2025, Airbnb's median annual revenue for 30A properties was $61,864, while VRBO's was $54,530. Listing on both platforms can help you reach broader audiences and boost your income.

Quick Comparison:

| Metric | Airbnb | VRBO |

|---|---|---|

| Guest Demographic | Younger, tech-savvy | Families, older groups |

| Booking Duration | Shorter stays (2–3 nights) | Longer stays (5–7+ nights) |

| Guest Fees | 5%-15% | 6%-12% |

| Median Revenue (2025) | $61,864 | $54,530 |

| Peak Season ADR | $638 | $644 |

| Occupancy Rate | 39.9% | ~40% |

Airbnb vs VRBO on 30A: Revenue, Fees, and Guest Demographics Comparison

Airbnb Data for 30A Properties

Booking Patterns Throughout the Year

Airbnb bookings along 30A show a clear seasonal trend. July marks the busiest period, while January is the slowest. During the peak months of May through July, properties in Santa Rosa Beach see an average 57.3% occupancy rate, with an average daily rate (ADR) of $638. These months generate an impressive average monthly revenue of $11,765.

In contrast, the low season from December through February paints a very different picture. Occupancy drops to 27.5%, and the ADR decreases to $456, resulting in a much lower monthly revenue of $3,585. In other words, peak season revenue is more than three times higher than winter earnings. On average, guests book their stays 65 days in advance, but this lead time stretches to 82 days for stays in November. These seasonal shifts have a direct impact on overall revenue.

Revenue Numbers for Airbnb Hosts

The median Airbnb property in Santa Rosa Beach brings in $61,864 per year, with an ADR of $544 and an occupancy rate of 39.9%. However, performance can vary significantly depending on the property’s location and quality. The top 10% of properties command nightly rates of $974 or more and earn monthly revenues exceeding $14,600, compared to the market median of $5,289.

For example, between December 2024 and November 2025, "Barefoot Bliss by Stay on 30a", a 6-bedroom home in Santa Rosa Beach, generated a staggering $572,244 in revenue with a 48.7% occupancy rate and an ADR of $2,997.78. Another standout, a 5-bedroom property managed by "NEW Inlet Beach", achieved a 72.1% occupancy rate, earning $138,076 in revenue with a more affordable ADR of $560.13.

On a broader scale, the property management company 360 Blue oversees 116 listings on 30A and reported an annual revenue of $12,599,399, with an average guest rating of 4.76/5.0.

Who Books on Airbnb and What They Want

The majority of Airbnb guests on 30A are domestic travelers, with 98% to 99% coming from within the United States. Atlanta and Nashville are the primary feeder cities. The guest demographic leans younger, with 50% being Gen Z and Alpha (born after 2000). This younger, tech-savvy audience prioritizes modern amenities and seamless digital experiences.

The area primarily caters to large groups and families. In Santa Rosa Beach, 66% of listings accommodate 8 or more guests, and 93.8% of properties in Walton County can host at least 6 people. Almost all active listings - nearly 100% - are entire homes, reflecting a strong preference for privacy and spacious accommodations. Guests consistently look for features like high-speed Wi-Fi, air conditioning, fully equipped kitchens, and washer/dryer setups. These amenities appeal not only to families on vacation but also to remote workers seeking longer stays.

VRBO Data for 30A Properties

Family and Group Rental Patterns

VRBO has carved out a niche in meeting the demand for whole-home rentals in the 30A region, catering to families and groups. The numbers back this up: between 97% and 99.7% of active listings in the area are entire homes or apartments. A significant 86.7% of these properties accommodate six or more guests, with an average capacity of 6.9 guests per property. Additionally, 60.1% of listings offer three or more bedrooms, and over half - 52.6% - can host eight or more guests. Houses dominate the market, making up 90.4% of active listings.

Booking trends also reflect the family-oriented nature of 30A. Occupancy rates see a noticeable dip in August, coinciding with the start of the school year. These patterns, combined with the property types available, set the stage for understanding VRBO's revenue performance in this market.

Revenue Numbers for VRBO Hosts

VRBO properties in 30A deliver strong financial returns, though results vary based on location and property quality. In Walton County, the median annual revenue for a listing is $54,530, with an average daily rate (ADR) of $567. Year-over-year, revenue has grown by 30.9%. At the high end, the top 10% of properties command nightly rates of $919 or more, generating monthly revenues that exceed $12,907. Prestigious neighborhoods see even higher ADRs, with Seaside leading at $789.36, followed by Alys Beach at $690.64 and Rosemary Beach at $665.77.

Seasonality plays a big role in revenue fluctuations. During the peak summer months (June through August), daily rates average $644, while in the slower months, they drop to $491. July is particularly lucrative, with ADRs reaching $682 and occupancy hitting 76% in 2023. On the flip side, February records the lowest rates and occupancy levels.

"Most of the big local rental companies do not utilize the major booking platforms like Airbnb, VRBO, etc. They rely solely on direct bookings through their respective websites... that's a lot of tourist traffic to miss out on."

- Avery Carl, The Short Term Shop

These revenue patterns are closely tied to occupancy rates and booking behaviors, which further highlight VRBO's influence in the 30A market.

Occupancy Rates and Length of Stay

As of late 2025, VRBO properties on 30A maintain an average occupancy rate of about 40%. This figure aligns with nearby communities, such as Seacrest Beach at 43%, and both Rosemary Beach and Alys Beach at 41%. Notably, 73% of properties in the area are listed on both Airbnb and VRBO.

Longer stays are a hallmark of VRBO's success in Walton County. Approximately 70.2% of listings require a minimum stay of 30 nights or more, appealing to remote workers, snowbirds, and families looking for extended vacations. Booking lead times also reflect this trend, with reservations made 30 to 59 days in advance increasing from 28% to 32% year-over-year. On average, guests plan their trips 50 days ahead, with lead times peaking at 59 days for October stays and 81 days for June stays.

Revenue per Available Night (RevPan) offers additional insight into earnings. In July 2023, properties on 30A achieved a RevPan of $521, which dropped to $160 by September. This highlights the importance of balancing occupancy rates with pricing strategies, rather than focusing solely on maximizing nightly rates.

"A balanced strategy of ADR and occupancy yields the highest revenue."

- Jason Koertge, Blue Swell STR Market Performance Reports

Direct Comparison: Airbnb vs. VRBO on 30A

Side-by-Side Metrics

On 30A, a notable 73% of property owners list their rentals on both Airbnb and VRBO, showing how intertwined these platforms are in the local market. The average daily rate in the region sits at $321, with a 60% occupancy rate - a 4% bump compared to the previous year. When it comes to revenue, the market's Revenue per Available Rental (RevPAR) averages $193.40.

Looking at exclusivity, 17% of properties are listed only on Airbnb, while 10% are exclusive to VRBO. Cross-listed properties tend to perform better with a 58% occupancy rate, compared to 54% for Airbnb-only listings and 52% for VRBO-only options. Booking behaviors also differ: Airbnb guests often prefer shorter stays of 2–3 nights, perfect for weekend trips, while VRBO tends to attract families planning longer vacations of 5–7 nights or more.

When it comes to fees, Airbnb charges hosts 3–5% and guests 5–15%, while VRBO guest fees range from 6–12%, which can make VRBO slightly more appealing for budget-conscious travelers.

These metrics highlight how each platform caters to different traveler preferences and impacts overall revenue. Now, let's dive deeper into the strengths and challenges each platform brings to the 30A market.

Pros and Cons of Each Platform

Airbnb stands out with its immense reach, boasting 78% brand awareness and over 7.7 million global listings. Its broad appeal attracts a diverse group of travelers, especially those seeking unique or unconventional stays. However, Airbnb's higher guest fees and its wide-ranging inventory can sometimes dilute the upscale image of 30A properties.

On the other hand, VRBO focuses exclusively on whole-home rentals, which perfectly aligns with 30A's market, where nearly all listings (99.6%) are entire homes. VRBO's audience leans toward families and older travelers who value privacy and extra space. With over 2 million listings and 50% brand awareness, VRBO faces less competition but also reaches a smaller audience. Its lower guest fees may improve booking conversion rates, even if the total number of booking opportunities is fewer.

"Research on Airbnb but book on VRBO... I generally find it cheaper."

- Kristin Addis, CEO, Be My Travel Muse

For hosts with family-friendly, larger properties, VRBO's inventory focus makes it a logical choice. Its emphasis on whole-home rentals resonates with the family-oriented travelers who dominate the 30A market. Meanwhile, Airbnb’s broader audience may be better suited for properties targeting shorter stays or a mix of guest types.

sbb-itb-d06eda6

Recommendations for 30A Property Owners

Using Both Platforms Together

Did you know that 78% of Santa Rosa Beach property owners list their properties on both Airbnb and VRBO? It’s a smart move. By using both platforms, you can reach two very different types of travelers. Airbnb tends to attract younger, more spontaneous guests, while VRBO often appeals to families planning longer vacations.

To make the most of this strategy, consider using dynamic pricing. This approach helps you stay competitive by analyzing demand across both platforms and adjusting your rates accordingly. Setting a "Floor Rate" is also key - it ensures you maintain profitability, especially during peak times like July, when revenues are at their highest.

Make sure your property listings highlight features that matter most to guests. With 66% to 73.7% of 30A properties catering to large groups, it’s crucial to emphasize amenities that offer space and privacy for families. Combining this attention to detail with a dual-platform strategy can help you tap into the unique strengths of each platform.

When to Use Each Platform

Airbnb shines when it comes to last-minute bookings and shorter stays. For example, in January, when lead times drop to just 33–49 days, offering 1-night stays during midweek or slower periods can attract guests that others overlook.

On the other hand, VRBO is ideal for peak season and longer family vacations. July is a prime example. Setting longer minimum stays and premium prices during this time can draw in families looking for traditional vacation experiences. To fine-tune your strategy, keep an eye on school calendars in key markets like Atlanta and Nashville. Adjusting your pricing around school breaks and holidays can make a big difference. Plus, VRBO’s lower guest fees (6–12% compared to Airbnb’s 5–15%) make it a budget-friendly option for families planning extended stays.

Main Takeaways

Success on 30A hinges on using both platforms effectively. The numbers speak for themselves: median annual revenues reach $61,864, with year-over-year growth rates between 30.9% and 37.6%. To boost your earnings, adjust your minimum stay requirements based on the season and consider implementing strict cancellation policies - something 52.4% of local hosts already do.

How to Price Your Airbnb in Destin, 30A, or Panama City Beach to Maximize Revenue Year Round (10/10)

FAQs

What are the key differences between Airbnb and VRBO for 30A vacation rentals?

Airbnb and VRBO both serve the vacation rental market along 30A, but they attract users with slightly different preferences and offer distinct approaches to fees and listings. Many property owners choose to list on both platforms to increase their exposure, though Airbnb generally has a marginally higher number of listings in the area.

Fee structures also set these platforms apart. Airbnb charges guests a service fee ranging from 5% to 15% of the booking total, while hosts are charged between 3% and 5%. VRBO, meanwhile, applies a guest booking fee of 6% to 12% and provides hosts with a simpler fee system. Hosts on VRBO’s subscription plan often enjoy lower costs, which can make VRBO listings appear more budget-friendly to guests compared to Airbnb, where fees may make prices seem higher at first glance.

For a closer look at how these platforms stack up along 30A, visit the local guide at sowal.co.

How do seasonal trends affect revenue for Airbnb and VRBO hosts on 30A?

Seasonal demand has a big impact on how much Airbnb and VRBO hosts along 30A can earn. The summer months, especially July, are the busiest, with average daily rates (ADR) ranging between $540 and $700. Occupancy rates during this peak season hover around 55–60%. For mid-range properties, this can mean annual earnings of $70,000–$80,000, while high-end beachfront homes can bring in over $1 million a year.

On the flip side, the winter months, like January and February, are much quieter. ADRs dip to the low $500s, and occupancy rates drop below 40%, cutting into potential income significantly.

Both Airbnb and VRBO follow this seasonal rhythm, with revenue peaking during the high-demand summer months. To make the most of this, hosts can adjust pricing dynamically and enhance their offerings with premium amenities to attract more guests. During the slower winter season, strategies like lowering rates or offering long-term rental options can help bridge the gap. For more tips on local trends, events, and travel advice, check out sowal.co to stay in sync with the 30A market's unique flow.

What are the benefits of listing a property on both Airbnb and VRBO?

Listing your property on Airbnb and VRBO can help you connect with millions of travelers who frequent these platforms. By being present on both, you open the door to a wider audience, catering to guests with different preferences and booking habits. This broader exposure can lead to more bookings and increased visibility.

Another benefit? You can take advantage of the differences in each platform's fee structures. This gives you the flexibility to fine-tune your pricing strategy to suit your goals. Plus, by diversifying your listings, you can improve occupancy rates and boost your overall revenue - especially in popular destinations like 30A along Florida's Gulf Coast, where demand often runs high.