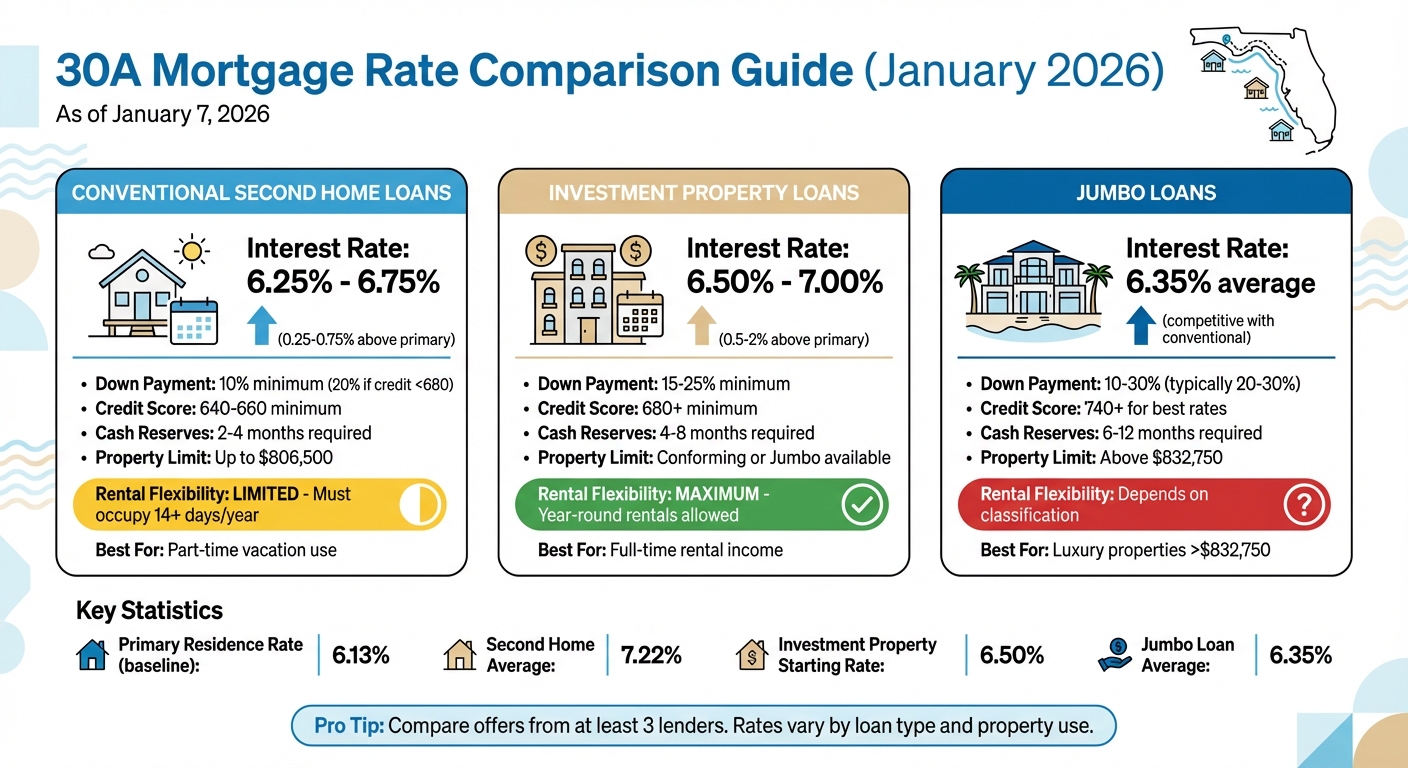

Buying a home along Florida's 30A corridor? Here's what you need to know about mortgage rates:

- Primary residence rates: Average 30-year fixed rate in Florida is 6.13% as of January 7, 2026.

- Second home rates: Typically 0.50% to 0.75% higher than primary residence rates; December 2025 average was 7.22%.

- Investment property rates: Generally 0.5% to 2% higher than primary residence loans; January 2026 rates start at 6.50%.

- Jumbo loans: For properties exceeding $832,750, rates are now competitive with conventional loans, averaging 6.35% for 30-year fixed terms.

Key Takeaways:

- Conventional second home loans require at least 10% down and are ideal for vacation homes used part-time. Rates are higher than for primary residences.

- Investment property loans demand 15%-25% down and allow year-round rentals but come with stricter qualifications and higher rates.

- Jumbo loans are necessary for luxury properties above the conforming loan limit. These loans have stricter requirements but competitive rates.

Pro Tip: Compare offers from at least three lenders to find the best terms for your 30A property. Rates and requirements vary depending on the loan type and property use.

30A Mortgage Rates Comparison: Second Home vs Investment vs Jumbo Loans

1. Conventional Second Home Loans

Rate Ranges

If you're considering a conventional loan for a second home, be prepared for higher interest rates compared to mortgages for primary residences. Why? Lenders view these loans as riskier. For example, in early January 2026, the average rate for primary residences was 6.04%. By comparison, second home rates ranged between 0.25% and 0.75% higher. This meant well-qualified borrowers, with a 720 FICO score, faced rates around 7.22% by late December 2025. Local lenders in Walton County, like CapCenter, offered 30-year fixed rates for primary residences starting at 6.000% as of January 7, 2026. For second homes, rates would likely fall between 6.25% and 6.75% for similarly qualified buyers.

Down Payment Requirements

Conventional second home loans typically require a minimum 10% down payment. However, if your credit score is below 680, you might need to put down 20% or more. Along 30A, where properties often exceed $700,000, even a 10% down payment can mean a hefty upfront investment - $70,000 or more in most cases.

In addition to the down payment, lenders usually require you to have two to four months' worth of cash reserves in the bank. This ensures you have enough liquidity beyond the initial costs. To qualify as a second home rather than an investment property, you must occupy the property for at least 14 days per year and retain control over who stays there. These requirements set the stage for understanding the full cost of the loan.

Loan Costs and Terms

The costs of a conventional second home loan go beyond just the down payment. Closing costs typically range from 2% to 6% of the loan amount. If you're looking to lower your interest rate, you can purchase discount points. For instance, CapCenter offered a 30-year fixed rate of 5.750% with one discount point (1% of the loan amount) compared to 6.000% with zero points.

To qualify, you'll need a minimum credit score of 660 and a debt-to-income ratio ideally below 36%, although some lenders may allow up to 45%. It's worth noting that conventional second home loans aren't eligible for FHA or VA programs, and you generally can't use rental income to qualify for the mortgage.

Suitability for 30A Properties

Conventional loans are a good fit for 30A properties priced under the conforming loan limit of $806,500. They're particularly suited for buyers planning to use the property primarily as a vacation home. However, for luxury beachfront estates in areas like Alys Beach, Seacrest, or Seaside that exceed this limit, jumbo loan options may be more appropriate.

One perk to keep in mind: the mortgage interest on your second home is tax-deductible on up to $750,000 of combined debt for your primary and second home. That said, second home mortgages accounted for only 2.6% of all U.S. mortgages in 2024. This highlights the niche nature of this type of financing and underscores the importance of working with lenders who have experience in the 30A market.

2. Investment Property Loans

Rate Ranges

Investment property loans come with higher interest rates compared to loans for second homes. As of January 7, 2026, 30-year fixed investment rates were 6.500% (6.612% APR) for conforming loans and 6.500% (6.560% APR) for jumbo loans. These rates are typically 0.5% to 2% higher than those for primary residences. A popular option for 30A investors is Debt Service Coverage Ratio (DSCR) loans, which qualify borrowers based on the property’s rental income instead of personal income. As of the same date, DSCR loans were available at 6.375% for a 75% loan-to-value (LTV) ratio and 6.500% for an 80% LTV ratio.

"A very general rule of thumb would be to expect to pay 1 to 2 percent more on an investment loan versus an owner-occupied loan."

– Jessica Vance, Loan Officer, Anchor Funding

These higher rates naturally lead to increased upfront and ongoing costs, discussed further below.

Down Payment Requirements

Investment property loans demand a larger down payment compared to loans for personal residences. Most lenders require a down payment between 15% and 25%. To secure the best rates, aim for at least 25% down to keep the loan-to-value ratio at 75% or below. Credit scores also play a role: borrowers with a score of 680 or higher may qualify with a 15% down payment, while those with lower scores (around 620) might need to put down 25%.

On 30A, where properties like Watersound homes start at $1,030,000 and Alys Beach homes can exceed $6,650,000, a 15% down payment means needing anywhere from $154,000 to nearly $1,000,000 upfront. In addition to the down payment, lenders typically require cash reserves equal to four to eight months of mortgage payments (including taxes, insurance, and HOA fees). Closing costs add another layer of expense, typically ranging from 3% to 6% of the purchase price.

Loan Costs and Terms

Beyond the down payment, other costs can significantly affect affordability. Loan-level price adjustments (LLPAs) can increase rates by 0.5% to 0.75% for single-family homes and 0.625% to 1.0% for multifamily properties. Origination fees may range from 0% to 2% of the loan amount. Additionally, lenders often require a debt-to-income (DTI) ratio below 43%.

Credit score requirements for investment loans typically fall between 620 and 680, with the most competitive terms available to those in the 660–700 range. Unlike second home loans, most investment property loans are recourse loans, meaning borrowers must provide a personal guarantee. For DSCR loans, lenders generally expect a Debt Service Coverage Ratio of 0.75 to 1.0, ensuring the rental income covers 75% to 100% of the debt obligations.

Suitability for 30A Properties

With its upscale real estate market and seasonal rental trends, 30A presents unique opportunities for investment property loans. These loans are ideal for buyers planning to rent out their properties on a short-term basis. For high-value properties exceeding the conforming loan limit of $832,750, jumbo loans are available at rates comparable to conforming loans (approximately 6.500% as of January 2026). However, jumbo loans often come with stricter reserve requirements, making them better suited for those targeting luxury beachfront homes in areas like Alys Beach and Seaside.

The 30-year fixed-rate loan is particularly appealing for managing seasonal income fluctuations along 30A, offering payment stability. While a 30-year term results in lower monthly payments - helping with cash flow - it also means paying more in interest over time. DSCR loans are especially attractive for investors aiming to scale their portfolios:

"Our borrowers are utilizing these loans to leverage into multifamily properties, fix them up and re-rent them at higher rates. This forces appreciation on a property and is scalable for our investor clients with large portfolios."

– Jessica Vance, Loan Officer, Anchor Funding

Because investment property loans can be complex and costly, it’s wise to compare offers from at least three lenders, including community banks and credit unions, to secure the best terms for your investment.

3. Jumbo Loans for Luxury 30A Properties

Rate Ranges

As of January 7, 2026, the average rate for a 30-year fixed jumbo mortgage stood at 6.35%, with an APR of 6.39% nationwide. Meanwhile, 15-year fixed jumbo loans averaged 5.69% with a 5.77% APR. These rates are now closely aligned with conventional loans, which average around 6.16% for 30-year terms - a notable shift in cost differences over recent years.

"Before the pandemic, jumbo mortgages had higher rates than conventional loans. Now, jumbo loans carry rates that are about equal to conventional mortgages. The catch is that the requirements for down payment and credit score can be stricter."

– Jeff Ostrowski, Housing Market Analyst, Bankrate

In Florida, any loan exceeding $832,750 is classified as a jumbo loan. Along 30A, where properties in areas like Alys Beach and Watersound often range from $1,030,000 to $31,000,000, jumbo loans have become the go-to financing option for buyers who aren’t paying in cash.

Down Payment Requirements

Traditional jumbo loans typically require a down payment of 20% to 30%, but some specialized programs allow for as little as 10%. In Walton County, lenders often structure jumbo loans with a 30% down payment (70% loan-to-value ratio) for high-end properties. For instance, purchasing a $2,000,000 beachfront home with a 30% down payment means putting down $600,000 upfront. In contrast, a 10% program would only require $200,000.

Choosing a lower down payment can help buyers maintain liquidity, but it comes with stricter qualification standards. Borrowers generally need a credit score between 680 and 780 and a debt-to-income ratio of 45% or less. Many lenders offering jumbo loans also waive Private Mortgage Insurance (PMI) requirements, even if the down payment is below 20%. However, buyers must demonstrate they have 6 to 12 months of cash reserves in liquid assets.

Loan Costs and Terms

Jumbo loans involve more rigorous underwriting compared to conventional loans. Lenders carefully review income documentation and may charge extra fees for specialized appraisals, particularly for high-value coastal properties. Since most lenders hold jumbo loans in their own portfolios rather than selling them to Fannie Mae or Freddie Mac, they often provide tailored terms.

Debt-to-income ratios for jumbo loans are capped at 45%, which is stricter than the 50% limit some conventional loans allow[39, 16]. For buyers who plan to own the property for a shorter period, adjustable-rate mortgages (ARMs) - such as 3/1 or 7/1 options - can offer lower initial rates, typically ranging from 5.47% to 5.83%, compared to fixed-rate alternatives.

Suitability for 30A Properties

With their tailored features, jumbo loans are the standard financing method for 30A’s luxury real estate market, where property prices far exceed conforming loan limits. These loans are commonly used for primary residences, vacation homes, and investment properties alike[35, 36].

To secure the best terms, consult at least three lenders, including local banks and credit unions. A credit score of 740 or higher will help you qualify for the most competitive rates.

sbb-itb-d06eda6

DESTIN Florida and 30A Florida Real Estate Market Update - July 16, 2025

Pros and Cons

Here’s a breakdown of the key trade-offs among the 30A financing options discussed earlier:

Conventional second home loans are appealing with a lower down payment requirement (around 10%). However, they come with strict occupancy rules that limit rental activity. Interest rates for these loans typically range from 0.25% to 0.75% higher than those for primary residences.

Investment property loans demand a higher down payment (between 15% and 25%) and stricter qualification standards, but they don’t impose occupancy restrictions. This makes them ideal for generating year-round rental income. That said, borrowers should be prepared for rates that are 0.50% to 0.75% higher than primary residence loans and tougher eligibility requirements. These loans are perfect for buyers aiming to maximize rental income on 30A.

Jumbo loans, which apply to properties priced above $832,750, now offer rates similar to conventional loans. However, they come with stricter requirements, including higher credit scores (740+), larger down payments (10%–30%), debt-to-income ratios capped at 45%, and cash reserves covering 6 to 12 months of mortgage payments.

"Before the pandemic, jumbo mortgages had higher rates than conventional loans. Now, jumbo loans carry rates that are about equal to conventional mortgages. The catch is that the requirements for down payment and credit score can be stricter." – Jeff Ostrowski, Housing Market Analyst, Bankrate

The table below compares these financing options to help you align them with your financial profile and investment goals on 30A.

| Loan Type | Rate Premium | Min. Down Payment | Min. Credit Score | Rental Flexibility | Best For |

|---|---|---|---|---|---|

| Conventional Second Home | +0.25% to 0.75% above primary | ~10% | 640–660 | Limited | Part-time vacation use with occasional rentals |

| Investment Property | +0.50% to 0.75% above primary | 15%–25% | ≥680 | Maximum | Full-time rental income generation |

| Jumbo Loan | Competitive with conventional | 10%–30% | 740+ | Depends on property classification | High-value properties exceeding $832,750 |

Conclusion

Understanding your financing options is key to choosing the right mortgage for your goals. For vacation homes that you’ll occupy at least 14 days a year, conventional second home loans might be the way to go. These typically require about 10% down and have interest rates that are 0.25% to 0.75% higher than primary residence loans. However, keep in mind that these loans come with occupancy rules that limit how much you can rent out the property.

If your goal is to generate rental income year-round, investment property loans could be a better fit. These require a higher down payment - usually 15% to 25% - and carry interest rates that are 0.50% to 0.75% above those for primary residences. They’re particularly well-suited for rental properties along the 30A corridor, where earning potential is strong.

For luxury homebuyers in high-end areas like Alys Beach or Rosemary Beach, jumbo loans are often necessary. As of January 7, 2026, jumbo loan rates are comparable to conventional loans at 6.35%. However, these loans come with stricter requirements, such as higher credit scores and down payments ranging from 10% to 20%.

It’s smart to shop around and compare offers from at least three lenders before making a decision. Mortgage rates for second homes can be higher than expected, so doing your homework can save you money. If you plan to hold onto the property for more than five years, consider paying points upfront to lower your interest rate over the long term.

With 30A’s unique market - characterized by limited land and high demand from affluent buyers - choosing the right financing is essential. Whether you’re looking for a personal getaway or an income-generating property, understanding your options ensures that your decision aligns with both your lifestyle and financial goals.

FAQs

What affects mortgage rates for vacation homes along 30A?

Mortgage rates for vacation homes along 30A are shaped by a mix of personal financial factors and broader market dynamics. Lenders often charge slightly higher rates for second homes, typically adding a premium of 0.25%–0.50% compared to rates for primary residences. Several personal factors, like your credit score, the size of your down payment, your debt-to-income ratio, and the type of loan you select - whether fixed or adjustable-rate - can heavily influence the rate you qualify for. Lenders also evaluate the property’s location, how you plan to use it, and its potential for seasonal rentals, as these factors impact their risk calculations.

National economic trends also play a big part in determining mortgage rates. Factors like inflation and consumer confidence directly influence rates, which have recently hovered between 6% and 7%. On a regional level, local factors along 30A - such as home price trends and demand - can affect lender competition and, in turn, the rates offered. If you’re looking to finance a vacation home in this area, it’s worth exploring resources that provide insights into 30A’s unique market and community.

What makes jumbo loans different from conventional loans?

Jumbo loans cater to properties priced above the Federal Housing Finance Agency (FHFA) conforming loan limits, classifying them as non-conforming loans. Because they fall outside these limits, lenders often impose stricter criteria. Borrowers are generally expected to have a higher credit score, a lower debt-to-income (DTI) ratio, and a larger down payment - typically about 20%. On top of that, lenders might also ask for proof of significant assets and financial reserves to ensure the borrower’s financial stability.

On the other hand, conventional loans come with more lenient credit and DTI requirements and are eligible for sale to entities like Fannie Mae or Freddie Mac, making them a more accessible option for many buyers. If you're thinking about purchasing a vacation home along 30A, knowing the distinctions between these loan types can guide you toward the financing option that aligns best with your goals.

What are the advantages of using DSCR loans for investment properties along 30A?

DSCR (Debt-Service-Coverage-Ratio) loans give investors the chance to qualify for financing based on a property's rental income potential rather than their personal income or credit history. This makes them particularly appealing for self-employed individuals or those with diverse income streams who might not have traditional W-2 documentation.

On 30A, where vacation rentals often bring in high nightly rates and maintain strong occupancy, DSCR loans provide a simpler path to approval. Investors can bypass employment verification, as loan qualification hinges on the property’s projected rental income. This often means access to higher loan amounts and lower down payments compared to conventional mortgages, making it more feasible to finance condos, beachfront homes, or even condotels.

With annual rental income for 30A properties ranging from $50,000 to $150,000, DSCR loans allow investors to tap into the area’s thriving vacation rental market. For expert advice on financing and optimizing rental opportunities on 30A, visit sowal.co.