- Beach Access: Homes near the beach or with private access earn higher nightly rates and maintain strong occupancy.

- Property Type & Layout: Single-family homes generate more revenue but have higher costs. Condos are cheaper upfront but often face HOA fees. Smart layouts with features like bunk rooms or private pools boost earnings.

- Seasonal Demand: Peak months (spring and summer) offer the best returns. Dynamic pricing vs. fixed rates tools help maximize revenue year-round.

- Operating Expenses: Management fees, insurance, and maintenance heavily impact profits. Self-managing or bundling services can reduce costs.

- Regulations & HOA Rules: Zoning laws for short-term rentals, parking limits, and HOA restrictions affect rental flexibility and income potential.

Quick Tip: The combination of location, property design, and effective cost management determines long-term profitability.

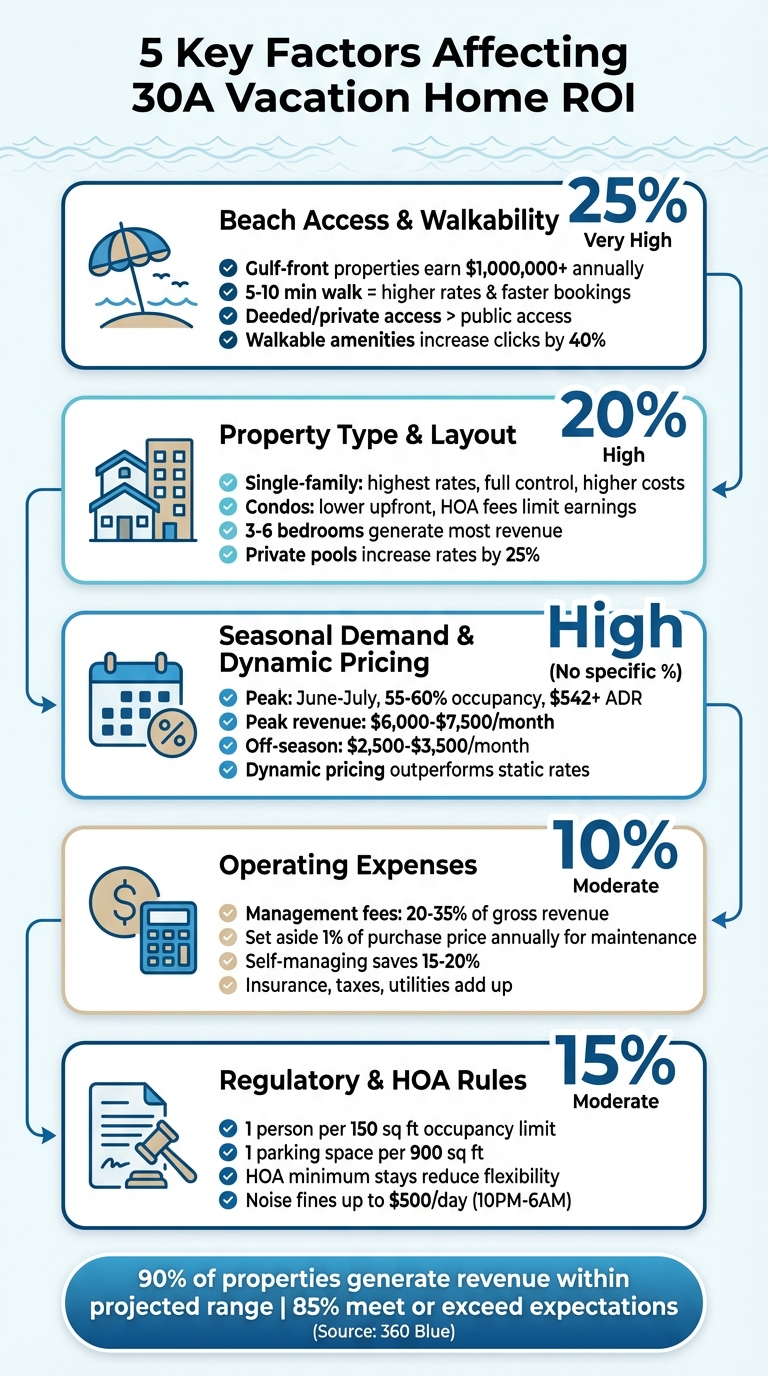

5 Key Factors Affecting 30A Vacation Home ROI with Impact Weights

1. Beach Access and Walkability

Proximity to the Beach and Guest Appeal

When it comes to rental ROI, being close to the beach is a game-changer. In professional ROI scoring systems for 30A properties, beach access and walkability account for a hefty 25% - the most important factor in the equation. Homes that offer shorter walks to the sand, fewer street crossings, and direct dune crossovers consistently outperform others, pulling in higher nightly rates and enjoying better occupancy year-round.

"Being a short, simple walk to the sand is one of the strongest demand drivers." - Christine Fox, Christine Fox Realty

Gulf-front properties are the gold standard for rental performance, thanks to their limited availability and overwhelming demand. Some of these prime beachfront homes can bring in over $1,000,000 annually. But even if a property isn't directly on the water, proximity still pays off. Homes within a 5–10 minute walk to beach access points tend to book faster and at higher rates compared to those requiring a drive.

The type of beach access is just as important as the distance. Public vs. private beach access gives properties a significant edge over those relying on crowded public access points. Families with young children or older guests especially appreciate this added convenience, leading to quicker bookings and a higher chance of repeat stays. Double-checking the path to the dune crossover and ensuring adequate parking can further enhance guest satisfaction and justify premium pricing.

But walkability isn’t just about reaching the beach. Properties near pedestrian-friendly town centers like Seaside, Rosemary Beach, or Alys Beach enjoy a rental boost. Guests love being able to walk to restaurants, shops, and parks without needing a car. These features not only encourage longer stays but also improve reviews. Highlighting walkable amenities with high-quality drone shots can increase listing clicks and bookings by as much as 40%.

Next, let’s dive into how property type and layout can further shape ROI.

sbb-itb-d06eda6

2. Property Type and Layout

Property Size, Type, and Functionality

While proximity to the beach can drive up booking rates, the type and layout of your property play an equally important role in determining your revenue potential. Single-family homes often command the highest rental rates and give you full control over amenities, but they come with higher costs for maintenance, insurance, and capital investment. Condominiums, on the other hand, are more affordable to purchase and offer shared amenities like pools and gyms. However, their earning potential can be limited by steep HOA fees and restrictive rental policies. Townhomes strike a balance between the two but may have drawbacks like vertical layouts and limited parking, which can deter families with young kids or older guests.

The layout of the property is another key factor that impacts guest satisfaction and your return on investment. Properties with 3 to 6 bedrooms typically generate the most revenue. A well-thought-out design - like a 3-bedroom property with a bunk room - can offer the same capacity as a traditional 4-bedroom home, increasing your earnings without requiring additional square footage.

"A smart layout with flexible sleeping spaces and adequate bathrooms can outperform a similar bedroom count without those features." - Christine Fox, Christine Fox Realty

Open-concept living spaces are highly sought after by today’s vacationers. Guests prefer layouts where the kitchen, dining, and living areas seamlessly connect, creating a welcoming space for group gatherings. Ensuite bathrooms not only enhance guest satisfaction but also simplify turnovers between bookings, leading to better reviews. Outdoor amenities like private pools can increase nightly rates by as much as 25%.

Extras like complimentary golf carts, bikes, or water sports equipment (think kayaks) can justify higher rental prices and encourage quicker bookings. Additionally, modern tech features - such as smart locks, high-speed Wi-Fi, and streaming-ready entertainment systems - are no longer optional. These conveniences are now standard expectations, and they can significantly enhance guest experience while improving your bottom line.

3. Seasonal Demand and Dynamic Pricing Strategy

Occupancy Trends and Pricing Strategies

To get the most out of your 30A rental, it’s crucial to keep an eye on seasonal demand. Peak season spans from Spring Break through summer, with June and July standing out as the top-performing months. During these months, occupancy rates typically reach 55–60%, and average daily rates (ADRs) climb to $542 or more - matching earlier performance benchmarks.

Late spring and early fall bring unique opportunities, as extended stays, weddings, and events like the 30A Songwriters Festival draw visitors. Winter, on the other hand, sees a steady influx of "Snowbirds" escaping the cold, along with holiday surges around Thanksgiving and Christmas. Monthly revenue reflects these trends, ranging from $6,000–$7,500 during peak months to $2,500–$3,500 in the off-season. This variability highlights the need for maximizing ROI in 30A through flexible pricing strategies.

Dynamic pricing, which uses real-time market data, consistently outperforms static rate cards. Tools such as PriceLabs, Beyond, and Wheelhouse simplify this process by analyzing competitor rates and historical trends to fine-tune your nightly pricing. Adjusting minimum stay requirements can also make a big difference: enforce 4–7 night minimums during high season to maximize ADR and cut turnover costs, then scale back to 2–3 nights in slower periods to attract short-term bookings.

As Emerald Coast Vacation Rentals puts it:

"Setting the right price isn't a one-and-done deal; it's an ongoing process."

To fill gaps during off-peak times, consider offering last-minute discounts of 10–15% for bookings made within two weeks of arrival. Cater to the "Snowbird" crowd by combining discounted long-term winter rates with higher prices during holiday peaks. Additionally, professional photos can increase listing clicks by 40%, and encouraging prompt reviews helps secure five-star ratings. Together, these strategies can help you manage expenses while maximizing revenue.

4. Operating Expenses and Cost Management

Expense Categories and Cost Control

Once you've maximized rental income with smart pricing and appealing property features, the next step is keeping operating expenses under control. These costs can heavily influence the return on investment (ROI) for your 30A vacation home. Key expense categories include mortgage payments, property management fees (typically 20–35% of gross revenue), homeowner insurance (often covering wind and flood risks), property taxes, cleaning and linen services, utilities, HOA dues, and routine maintenance. Additionally, don't forget to budget for capital expenditures such as roof repairs, HVAC upgrades, and interior updates - kitchens, bathrooms, and mattresses all require periodic replacements.

Gulf Tide Vacation Rentals offers a practical guideline:

"Experts recommend setting aside 1% of the property's purchase price annually for maintenance."

For a home valued at $1.2 million, this translates to about $12,000 per year for maintenance and unexpected repairs. For example, a 4,000-square-foot home might rack up around $560 per month in summer electricity costs, not to mention monthly expenses for water, internet, pool upkeep, and cleaning. With these recurring costs in mind, managing property fees becomes a critical area of focus.

One of the largest variable expenses is property management. Full-service management companies usually charge between 20% and 35% of your gross revenue. However, self-managing through platforms like Guesty, Hostfully, or OwnerRez can reduce these fees by 15–20%. As Andy Beal, a Realtor at Andy on 30A, points out:

"Saving the typical 15–20% management fee can be a game-changer."

There are additional ways to cut costs. Look into bundling services to secure volume discounts, schedule regular preventive maintenance (like quarterly HVAC checks and gutter cleaning), and install programmable thermostats to set A/C limits (e.g., no lower than 75°F when the property is vacant) to reduce energy bills. Consulting a CPA for depreciation strategies can also help lower your overall expenses.

Insurance is another significant cost, especially in Florida's coastal areas. Rising premiums, driven by frequent natural disasters and increased litigation costs, have made this a challenging market. To manage these costs, consider bundling wind, flood, and liability insurance policies, raising deductibles, and reviewing your coverage annually with a Florida coastal insurance specialist. These steps can ensure you’re adequately protected without overpaying. Fine-tuning your insurance strategy is an essential part of keeping your operating expenses under control.

5. Regulatory Environment and HOA Flexibility

Zoning, HOA Rules, and Tax Obligations

If you're considering a vacation rental in Walton County, it's crucial to understand the local regulations. The county defines a vacation rental as any property rented more than three times a year for stays under 30 days. This means you'll need to navigate zoning requirements, HOA restrictions, and tax obligations.

Occupancy and Parking Rules

Walton County enforces strict limits on occupancy and parking. Occupancy is capped at one person per 150 square feet of heated and cooled space. For example, a 2,400-square-foot home can host up to 16 guests. Parking requirements mandate one off-street parking space per 900 square feet or one space for every six occupants. Violating these rules could lead to fewer bookings or the need for additional permits, both of which can eat into your income. These restrictions play a key role in shaping your rental strategy.

HOA Restrictions

HOA rules often go beyond county regulations. Some communities enforce minimum stay requirements of three to seven nights, impose stricter occupancy limits, or even require property owners to work with specific management companies. Such rules can reduce your flexibility, making it harder to accommodate last-minute bookings or short weekend stays. It's wise to review HOA covenants carefully, ideally with legal assistance, since these rules carry enforcement powers that go beyond county codes.

Tax and Registration Requirements

Tax obligations are another important factor. You'll need to register for Florida state sales tax, Walton County's Tourist Development Tax, and renew your vacation rental certificate annually, based on your zip code. For properties in the 30A zip code (32459), the renewal deadline is January 31 each year. Unlike primary residences, which may benefit from up to $50,000 in exemptions, investment properties are taxed at full market value without the Homestead Exemption or Save Our Homes cap. Early payment discounts for property taxes range from 1% to 4%, depending on the payment month.

Compliance Costs

Operating a vacation rental also comes with compliance expenses. Requirements include having a "Responsible Party" available 24/7, installing fire extinguishers on each floor, adding battery-powered emergency exit lighting, and conducting balcony inspections every three years for buildings three stories or taller. Noise violations between 10:00 PM and 6:00 AM can result in fines of up to $500 per day. While these measures are essential for safety and legal compliance, they add to your operating costs and management responsibilities. Meeting these requirements helps protect both your property and your rental income.

Factor Comparison Table

The table below breaks down how various factors influence the return on investment (ROI) for 30A vacation homes. For instance, beach access has a major impact - accounting for 25% of ROI - by directly boosting nightly rates and occupancy levels. On the other hand, property type plays a key role in shaping your expense structure. Single-family homes often yield higher revenues but come with full maintenance responsibilities. Condos, while offering lower upfront costs, limit potential earnings through HOA fees.

Each factor's direct and indirect effects on ROI are highlighted. For example, properties closer to the beach command higher rates and attract more bookings, but they also incur higher operating costs like cleaning and utilities due to increased guest turnover. Similarly, larger homes with 3 to 6 bedrooms appeal to multigenerational groups willing to pay premium rates, though they also require more frequent upkeep and generate higher utility expenses. This table simplifies the interplay of these factors, building on earlier discussions around beach access, property type, and seasonal pricing.

| Factor | ROI Impact Weight | Primary Effect | Key Connection to Other Factors |

|---|---|---|---|

| Beach Access & Walkability | Very High (25%) | Drives up nightly rates and increases bookings | Tied to seasonal demand and higher variable costs, such as utilities and cleaning |

| Property Type & Layout | High (20%) | Sets revenue potential and shapes expense structure | Single-family homes offer higher control but higher costs; condos have lower upfront costs but incur HOA fees |

| Seasonal Demand & Pricing | High | Generates significant revenue during peak periods | High summer occupancy increases turnover and expenses; dynamic pricing helps balance costs |

| Operating Expenses | Moderate (10%) | Management fees (20–35%) and insurance reduce net profits | Larger properties and luxury amenities raise costs; higher occupancy leads to more variable expenses |

| Regulatory & HOA Rules | Moderate (15%) | Restricts occupancy and rental flexibility | HOA rules and stay requirements can limit revenue potential, especially for larger properties |

To compare property types effectively, use Revenue per Available Room (RevPAR). For example, while a beachfront condo with high HOA fees might generate less gross revenue than a single-family home, its lower maintenance costs and shared amenities could make the ROI more competitive. The key takeaway? Focus on how these factors interact in your specific scenario rather than evaluating them in isolation.

Conclusion

The return on investment (ROI) for a 30A vacation home hinges on a mix of factors: beach access, property type, seasonal demand, operating expenses, and local regulations.

According to local experts like 360 Blue, 90% of properties they evaluated generated gross annual revenue within their projected range, with 85% meeting or exceeding expectations. As Andy Beal, a 30A Realtor, explains:

"Maximizing ROI on 30A isn't about a single silver-bullet tactic. It's the sum of smart pricing, elevated guest experiences, streamlined operations, savvy tax planning, and trusted local partnerships".

To avoid surprises, review HOA meeting minutes for rental restrictions and consult local property managers for pro formas based on real revenue data from similar homes. These steps can help you identify properties with strong potential while steering clear of hidden pitfalls.

Local expertise offers a unique edge. Resources like sowal.co provide valuable insights into hidden beach access points, community events, and dining options that can make your property more appealing to guests. These details are key to attracting visitors looking for an authentic South Walton experience, which can lead to higher occupancy rates and repeat bookings. As Christine Fox from Christine Fox Realty points out:

"On 30A, rules vary block by block. Some HOAs set minimum stays, occupancy caps, or require registration and local management".

Understanding these nuances before buying is crucial.

FAQs

How does having beach access impact the ROI of a vacation home on 30A?

Beach access is a huge advantage when it comes to increasing the return on investment (ROI) for vacation homes along 30A. Homes with direct access to the beach or Gulf-front views are especially appealing to renters, allowing owners to charge higher nightly rates - sometimes as much as 25% more compared to properties without that perk.

On top of that, these properties often see better occupancy rates year-round, as vacationers consistently prioritize staying close to the beach. This mix of strong demand and the ability to charge premium prices makes beach access a crucial element in boosting rental income and property value.

What are the cost differences between owning a single-family home and a condo on 30A?

When deciding between a single-family home and a condo on 30A, the financial differences can play a major role in shaping your investment.

Single-family homes tend to come with higher purchase prices and ongoing expenses. These might include maintenance, repairs, landscaping, and property taxes. While owning a home gives you more freedom and control over the property, these costs can stack up over time. Depending on the home's value, you might also face higher mortgage payments.

Condos, on the other hand, typically have lower upfront costs. They also include homeowners association (HOA) fees, which often cover maintenance tasks like landscaping and upkeep of shared spaces. However, HOA fees can vary significantly, especially if the property offers luxury perks like pools or private beach access. It's also worth noting that condos often come with HOA rules, which could limit renovations or how you use the property as a rental - factors that can influence your return on investment (ROI).

Ultimately, the choice boils down to your budget, how much control you want, and your long-term investment goals.

How do dynamic pricing tools help maximize vacation rental revenue year-round?

Dynamic pricing tools are designed to help you boost revenue by automatically adjusting your rental rates. They take into account various factors like market demand, seasonal trends, local events, and occupancy patterns. By analyzing real-time data, these tools ensure your property stays competitively priced, making it more appealing to potential guests while maximizing your earnings.

With dynamic pricing, you can capitalize on peak seasons by charging higher rates when demand is strong. At the same time, it helps maintain consistent bookings during quieter times by offering competitive pricing. The result? A better balance of occupancy and profitability, enhancing the overall return on your vacation rental investment.